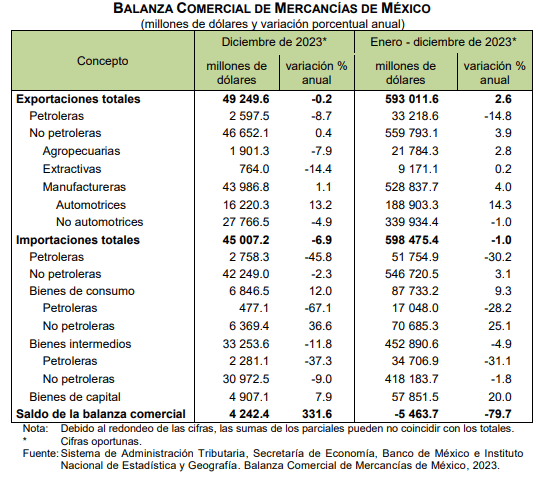

Mexico‘s exports (merchandise, excluding services) were US$593.012 billion in 2023, an increase of 2.6% over 2022.

Since its foreign purchases fell 1.0% to 598.475 billion dollars, the country had a deficit of 5.464 billion dollars.

Among the companies that export the most from Mexico are Pemex, General Motors, Nissan, Stellantis, Volkswagen, Ford, Coca Cola FEMSA, Grupo México, Industrias Peñoles, Mabe, Nestlé and Grupo Modelo.

Manufacturing exports amounted to 528,837 million dollars, an interannual increase of 4.0%, according to Inegi data.

Within Mexico, foreign automotive sales totaled 188.903 billion dollars, an increase of 14.3%, and non-automotive sales totaled 339.934 billion dollars, a drop of 1%.

Mexico exports cars, oil, trucks, telephones, computers, stoves, auto parts, refrigerators, gold, silver, copper, beer, tequila, avocados, red tomatoes, chili peppers and medical devices, among other products.

Mexico’s exports

Mexican foreign sales were $461 billion in 2019, fell to $417 billion in 2020 (the year most impacted by the pandemic), recovered to $495 billion in 2021 and climbed to $578 billion in 2022.

Despite the fact that Mexico has free trade agreements with 50 countries and shares a border with the United States (one of the largest markets in the world), the internationalization of Mexican companies is limited, according to a report released by the World Bank.

Most exporters have a regional focus and few have any connection with local entrepreneurs and suppliers.

However, in particular, companies that manage to integrate into global value chains (GVCs) or export directly tend to achieve higher growth rates and were more resilient during the Covid-19 pandemic.

Value-added

Mexico’s extensive network of free trade agreements has not resulted in broad participation in GVCs or high domestic value added.

A very limited number of Mexican companies export or are integrated into GVCs.

Mexico has signed free trade agreements that include 50 countries, but its exports lag behind their relevant peers.

Moreover, according to the same analysis, only 8.3% of companies in Mexico export at least 1% of their sales, either directly or indirectly.

However, for the 3,385 companies with exports greater than 1%of their sales in 2013 and 2018, exports grew at an average annual rate of 9.6% during this period.

The percentage of companies exporting high-tech products exceeded their expected percentages, given Mexico’s GDP.

Mexico’s exports are expected to continue to gain market share in the United States, of which it was the largest trading partner in 2023.