The main taxes in customs collection in Mexico in 2024 were VAT, IEPS, IGI and DTA, in descending order, according to data from Mexico‘s National Customs Agency (ANAM).

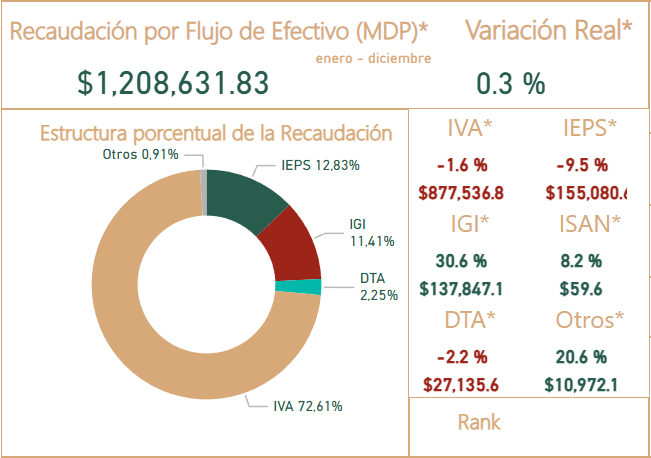

In 2024, Mexican customs collected 1 trillion 2,08,631 million pesos, implying a year-on-year increase of 0.3 percent.

Main taxes

The Ministry of Finance and Public Credit (SHCP) is in charge of collecting taxes on foreign trade. These taxes correspond to the levies established by law. They must be paid according to the rates set by the laws in force. Foreign trade taxes are levied on the import and export of goods and services within Mexican territory.

Of the total customs revenue in 2024, Value Added Tax (VAT) represented 72.61%. In Mexico, individuals and legal entities that, within Mexican territory, carry out acts such as the alienation of goods, rendering of independent services, importation of goods or services and granting the temporary use or enjoyment of goods are obligated to pay VAT.

In second place, the Special Tax on Production and Services (IEPS) accounted for 12.83% of Mexican customs revenue. This tax is levied on the production, sale or import of certain products. These include gasoline, alcohol, beer, tobacco, food, soft drinks with high caloric density, candies and insecticides.

The IEPS is an indirect tax. This means that taxpayers pass it on or charge it to their customers. In this case, the customers are the subjects of the tax obligation. Thus, the payment of the tax falls on the final consumer.

Mexican imports

Through the General Import Tax (IGI), Mexico collected 11.41% on customs operations. IGI is classified into three types: Ad valorem, specific and mixed. Ad valorem tax is calculated as a percentage of the customs value of the imported merchandise. On the other hand, the specific tax is established in monetary terms and is calculated per unit of measurement of the merchandise. Finally, the mixed tax combines both of the above rates.

Finally, the Customs Processing Fee (DTA) represented 2.5% of customs revenue. The DTA is the fee charged for the presentation of the pedimento at customs.