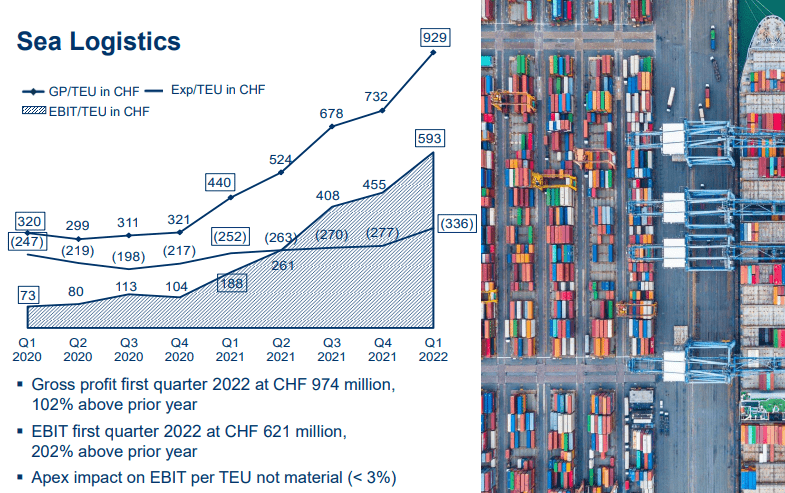

Kuehne + Nagel posted a 4% year-over-year drop in volumes in its Sea Logistics business in the first quarter of 2022, to 1,048 TEUS.

That same indicator increased 1.9% in all of 2021, to 4,613,000 TEUS.

Specialized services for controlled temperature cargo in refrigerated containers, pharmacy and electronic commerce contributed significantly to this last result.

In an uncertain and volatile market environment during the Covid-19 pandemic, Kuehne + Nagel maintained its global leadership position in maritime logistics.

As of May 11, 2021, the company legally acquired 79.3% of the shares of Apex International Corporation (Apex) and gained current access to another 9.1% of Apex shares that it has contractually agreed to transfer over the next three years.

Therefore, Kuehne + Nagel represents an 88.4% interest at the time of acquisition.

Apex is one of the leading Asian freight forwarders, especially in the trans-Pacific and intra-Asian.

The group of companies is a renowned specialist in air logistics services, founded in China in 2001 and headquartered in Shanghai and Hong Kong.

Apex has operations in 13 countries at various locations in China, Hong Kong, the United States, Vietnam, Taiwan, Korea, Singapore, Canada, Mexico, Australia, New Zealand, the Netherlands, and Germany.

Kuehne + Nagel

In 2021, the world economy experienced a global economic rebound with estimated growth of 5.5% after the Covid-19 recession the previous year (2020: -3.4% growth).

While the recovery was temporarily negatively impacted by local lockdowns and reduced overall activity, the global economy has gathered momentum to reach pre-pandemic levels.

In parallel, in 2021, the international logistics industry experienced global trade volume growth above the 2020 level, with an estimated increase of 9.3% in 2021 vs. -8.2% in 2020.

Logistics operations were shaped by disruptive events in global supply chains, some due to the pandemic and others due to operational bottlenecks in transportation, port and trucking operations.

On the ocean and air carriers side, the market in 2021 was characterized by a significant increase in freight rates caused by capacity shortages due to supply chain disruptions and operational inefficiencies.

This generated a severe cost-increasing effect on the company’s operational efforts to execute shipments, but also a significant expansion of gross margins.

![]()