The global integrated circuits market posted sales revenue of $462.9 billion in 2021, which is a 28.1% year-on-year increase and a record, according to Frost & Sullivan (F&S) estimates, referenced by Nano Labs.

Global sales revenue for the IC industry experienced fluctuations and increased from $343.2 billion in 2017 to $462.9 billion in 2021, representing a Compound Annual Growth Rate (CAGR) of 7.8 percent.

Moving forward, the integrated circuits market is expected to reach $700.7 billion in 2026, with a CAGR of 8.6 percent between 2021 and 2026.

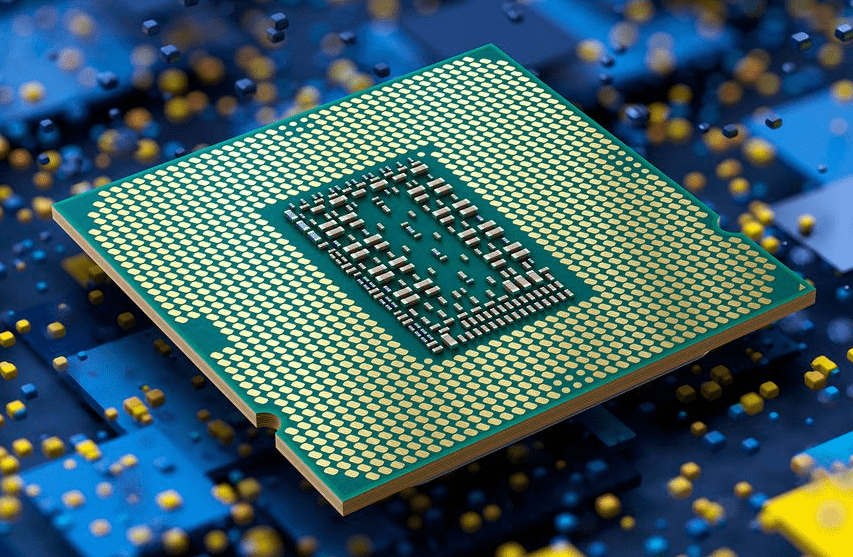

Integrated circuits market

In part, this momentum would be driven by the emergence of cutting-edge technologies such as 5G, the Internet of Things and cloud computing, as well as the need for products to be implemented with more chips, memories and other IC products.

Integrated circuits (ICs) are small pieces of semiconductor material, usually silicon, that contain a set of electronic circuitry where thousands of resistors, capacitors and transistors are fabricated.

An IC has a wide variety of applications and is commonly used as a microprocessor, memory and amplifier.

ICs can be classified into two types: processing ICs and other ICs.

While the latter include memory and other chips, such as baseband and radio frequency chips, processing ICs can be classified into two main types, namely general-purpose and application-specific integrated circuits, or ASICs.

Unlike general-purpose ICs, such as central processing units, or CPUs, graphics processing units, or GPUs, and field-programmable gate arrays, or FPGAs, an ASIC is customized for a specific use and can provide a speed improvement because it is designed specifically to perform a certain task.

In addition, because an ASIC contains only the circuitry needed for the specific application, it can be designed with a smaller physical size, requiring only lower power consumption while maintaining higher operating efficiency, and is easier to deploy in small or mobile devices.

Companies

From the beginning to the end, the IC industry contains many types of industrial players, such as equipment suppliers, integrated device manufacturers or IDMs, IC design providers, foundries and distributors.

The intermediate stage of the IC industry is mainly composed of IDMs and the fabless business model.

While integrated device manufacturers, such as Intel and Samsung, usually design, manufacture and sell IC products themselves, IC design companies use what is known as the fabless business model, whereby they cooperate with pure foundries for all stages of the IC manufacturing process.

More specifically, under the fabless business model, IC design companies only provide product specifications, algorithm design, front-end and back-end verification, chip assembly and testing, if necessary, without manufacturing ICs, and outsource manufacturing, packaging and testing of ICs to trusted external foundries, such as Taiwan Semiconductor Manufacturing Company (TSMC), Global Foundries, United Microelectronics Corporation (UMC) and Semiconductor Manufacturing International Corporation (SMIC), which operate for the purpose of manufacturing IC design companies’ designs.

![]()