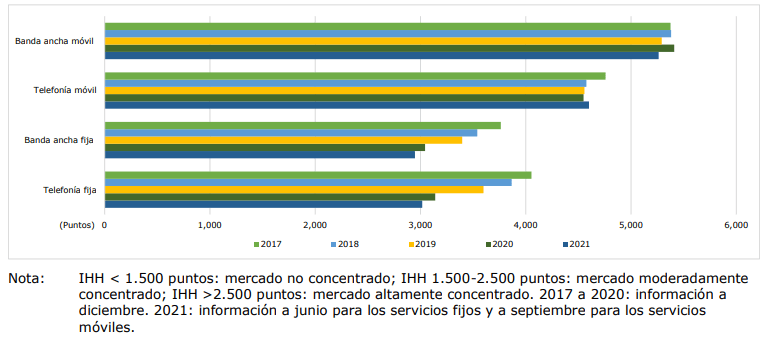

Mexico maintains a highly concentrated telecommunications market, according to the Herfindahl-Hirschman Index (HHI) for the last five years.

Competition in fixed telephony and fixed broadband increased over the last five years as a result of asymmetric regulation measures, which is reflected both in the reduction of América Móvil’s market share and in the degree of concentration, as measured by the HHI.

At the same time, the mobile market has failed to promote competition.

In any case, despite the increase in competition, each market segment in Mexico remains highly concentrated, as the HHI in all markets exceeds 2,500 points.

Grado de concentración en el mercado de las telecomunicaciones, 2017-2021

Fuente: IFT.The commercial use of spectrum frequency bands requires a concession that the Federal Telecommunications Institute (IFT) tenders and awards for a (renewable) 20-year period.

Generally, the bands are tendered to provide service throughout the territory.

But in some cases they may be tendered to provide services by region or locality.

Telecommunications market

All operators may participate in the bidding process, except for the preponderant economic agent (AEP), which requires authorization from the IFT.

Upon granting (and renewing) a concession, operators pay a fee, the amount of which is set by the IFT, subject to the opinion of the Ministry of Finance and Public Credit (SCHP).

In addition, concessionaires pay the annual fees determined by Congress as proposed by the SHCP.

According to the IFT, the use of the spectrum in Mexico has a high cost; annual fees represent 80% of the total cost.

In 2021, Congress increased the amount of annual fees for several frequency bands and introduced annual fees for bands that were exempted.

The IFT considers that this increase could impede investments; disincentivize the participation of current operators in bidding processes; and create barriers to entry for new entrants, which could impact end-user fees and accelerate the spectrum return process that began in 2019.

According to Mexican authorities, the spectrum return process will result in an annual revenue loss of Ps. 4.5 billion.

In 2021, the IFT tendered frequency blocks, but several of these were left deserted; as a consequence the Institute submitted a proposal for the amount of the annual fees to be modified.