Merchandise exports from Mexico to the United States registered an inter-annual growth of 17.6% in October, to 40.377 billion dollars.

Conversely, sales of U.S. products to the Mexican market rose at an annual rate of 15%, to 28.009 billion dollars, according to Commerce Department statistics.

The U.S. economy moved with ups and downs as it was affected by Covid-19 and its variants, inflation at 40-year highs, supply chain shortages, rising interest rates and the fallout from the Ukraine war.

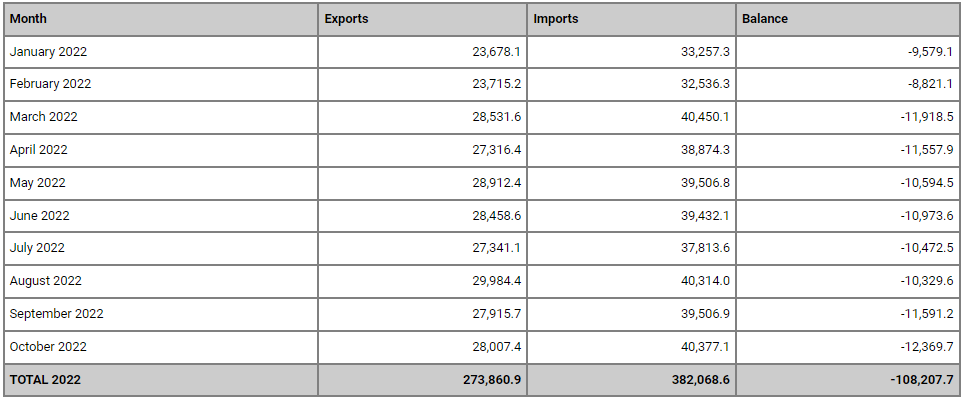

2022: U.S. trade in goods with Mexico (millions of dollars).

These headwinds were offset at times by continued fiscal spending, strong employment growth and overall strength in consumer spending.

From around the world, imports to the United States were $282.709 billion (+12.5 percent year-over-year), while cumulatively for the first 10 months of the current year totaled $2.737.016 billion (+18.3 percent).

Merchandise exports

U.S. foreign sales in October grew 10.2 percent to $180.411 billion, while for the first 10 months of the current year they totaled $1 trillion 724.356 billion, implying a 19.9 percent increase, year-over-year.

Looking back, U.S. annualized gross domestic product (GDP) in the third quarter of 2021 was 2.3 percent. The economy grew 6.9 percent in the fourth quarter of the year.

Next, GDP contracted 1.6 percent in the first quarter of 2022. Finally, the Commerce Department reported that second quarter annualized GDP was -0.6 percent.

Meanwhile, the Federal Reserve Board kept the federal funds rate, the interest rate at which depository institutions trade overnight federal funds (balances held at Federal Reserve Banks) with each other, at a record low of between 0.00 and 0.25 percent.

However, with inflation reaching four-decade highs, the Fed in March 2022 raised the fed funds rate to a range between 0.25 and 0.50 percent.

This was the central bank’s first rate hike since 2018. The Fed raised rates again at its May, June and July 2022 meetings.

These hikes brought the federal funds rate to a range between 2.25 and 2.50 percent.

Finally, in September – after the benchmark period ended – the fed funds rate was raised to a range between 3.00 and 3.25 percent.

![]()