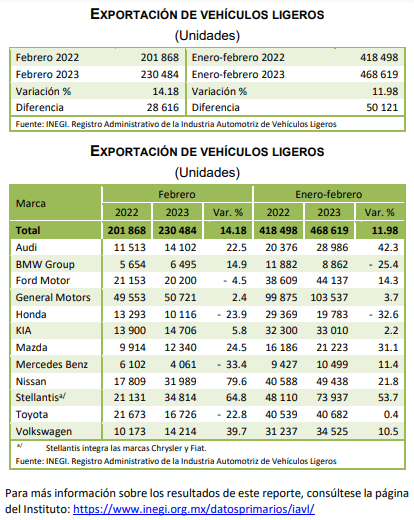

Among Mexico‘s auto exporters, General Motors ranked first in the first two months of the current year (103,537 units, +3.7% year-on-year).

Next positioned, in descending order: Stellantis (73,937 units, +53.7%), Nissan (49,438, +21.8%), Ford (44,137, +14.3%) and Toyota (40,682, +6.4 percent).

Exports of automobiles (light vehicles) grew 12% in the first two months of 2023, to 468,619 units, Inegi reported on Monday.

Due to the evolution of global economic conditions since 2020, initially as a result of the Covid-19 pandemic, the automotive industry experienced a decrease in production volumes and global customer sales.

Although global automotive industry production has recovered modestly with production increasing 7% in 2022 compared to 2021 and is expected to increase 3% in 2023 compared to 2022 (according to January 2023 projections from S&P Global Mobility, formerly IHS Markit), production remains well below recent historical levels.

Auto Exporters

According to auto parts company Lear Corporation, global industry production in 2022 was approximately 8% below pre-pandemic 2019 levels and 16% below 2017 peak levels.

Since 2020, industry and economic conditions have been influenced directly and indirectly by macroeconomic events such as the pandemic and, beginning in the first quarter of 2022, the conflict between Russia and Ukraine, resulting in unfavorable conditions, including shortages of semiconductor chips and other components, elevated levels of inflation, higher interest rates, and labor and energy shortages in certain markets.

Lear stated that these factors, among others, are affecting consumer demand, as well as the ability of automakers to produce vehicles to meet demand.

Other Mexican automobile exporters include: Volkswagen, Kia, Audi, Mazda, Mercedes Benz and BMW Group.

In American Axle & Manufacturing Holdings‘ view, the cyclical nature of the automotive industry, volatile raw material prices, changing consumer preference demands, regulatory requirements and trade agreements require OEMs and suppliers to maintain agility in product development and global capacity.

In order to effectively drive technology development, recognize cost synergies and increase global presence, the industry can continue to see consolidation of the supply base as companies recognize and respond to the need for scalability.

![]()