Tensions in the banking sector and tightening financial conditions have exacerbated downside risks to the U.S. economic outlook, said the Economic Commission for Latin America and the Caribbean (ECLAC).

Regional banks play a leading role in lending to businesses.

In ECLAC’s view, business investment, particularly in small businesses and commercial real estate, is likely to come under further pressure as lending conditions tighten.

According to a Credit Suisse analysis, about 18% of commercial and industrial (C&I) loans and 67% of commercial real estate loans are held by banks below the 25 largest institutions in size, and it will be difficult for larger banks to fill the gap from reduced lending by smaller regional banks.

For ECLAC, banking strains are likely to accelerate the transmission of tighter monetary policy to the real economy.

Lending standards have already been tightening for a few quarters and this trend is expected to accelerate as the banking sector tightens credit and tighter banking regulation becomes more likely.

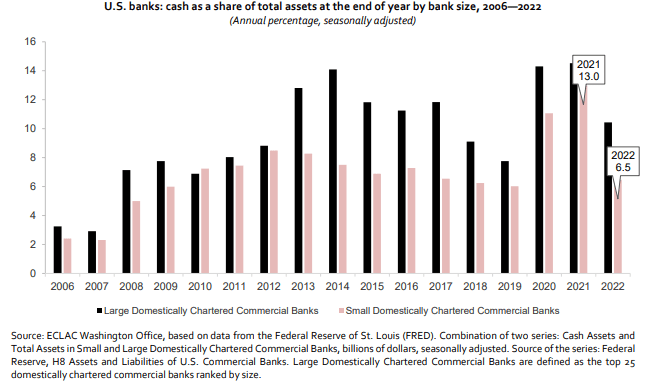

However, the risk of deposit flight and contagion in funding markets appears to have eased in recent weeks due to the joint action by the U.S. Federal Reserve, the Treasury Department and the Federal Deposit Insurance Corporation announced in early March, which appears to have helped ease depositors’ concerns and limit the need for banks to liquidate assets in a stressed market.

Banking sector

The U.S. economy is expected to lose momentum going forward. The combination of persistently strong inflation and tightening credit conditions due to strains in the banking sector leaves the Federal Reserve in a difficult position as it nears the end of its monetary policy tightening cycle.

For the time being, the central bank is addressing both problems by raising interest rates further to control inflation, while providing generous liquidity support to banks.

However, ECLAC said that tighter credit conditions are expected to weigh on the economy over time, contributing to lower demand and inflation, and perhaps a reversal of the monetary policy cycle.

Uncertainty has increased, and while some market analysts expect a recession this year, others believe that as long as consumption fundamentals remain resilient, a recession could be avoided.

![]()