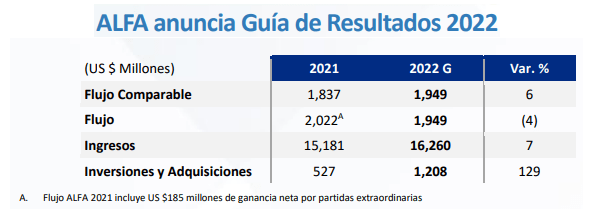

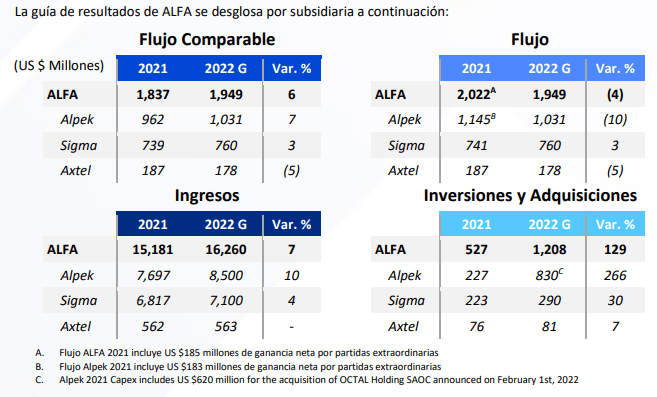

ALFA reported that it plans to more than double (+129%) its investments and acquisitions in 2022, to 1,208 million dollars, with increases in its three subsidiaries: Alpek, Sigma and Axtel.

Half of this item will be used in the acquisition of OCTAL Holding SAOC (Octal), for 620 million dollars.

On January 31, 2022, Alpek -a subsidiary of ALFA- signed an agreement to acquire 100% of the shares of Octal, for the aforementioned amount, free of debt.

Alpek

This acquisition would represent a vertical integration for Alpek into the high-value PET sheet business.

Octal is a major producer of PET sheet globally through a strategically focused logistics position in Oman.

Above all, the acquisition adds more than one million tons of installed capacity to Alpek.

The transaction is subject to customary closing conditions, including approval by the relevant regulatory authorities.

For now, Alfa expects the acquisition to be completed in the first half of 2022.

ALFA

This conglomerate manages a diversified portfolio of leading businesses with global operations:

Sigma, a leading multinational company in the food industry, focused on the production, marketing and distribution of quality products, through recognized brands in Mexico, Europe, the US and Latin America.

Alpek, one of the world’s leading producers of polyester (PTA, PET, rPET and fibers) and leader in the Mexican market for polypropylene and expandable polystyrene.

Axtel, an Information and Communications Technology (ICT) company that serves the business and government markets in Mexico.

In 2021, ALFA generated revenues of 308,060 million pesos (US $15,181 million) and Operating Cash Flow of $41,050 million pesos (US $2,022 million).

The conglomerate has been developing a strategy that seeks to capture the growth opportunities offered by its current businesses and those related to it, either organically or through acquisitions.

To this end, the ALFA companies prepare investment plans that allow them to achieve the stated objectives, taking advantage of the skills they have developed over time.

ALFA studies the macroeconomic and business assumptions on which the investment plans of its companies are based, ensuring that the established financial goals are achieved.

The company also ensures that these individual plans harmonize with its own long-term strategic objectives.

![]()