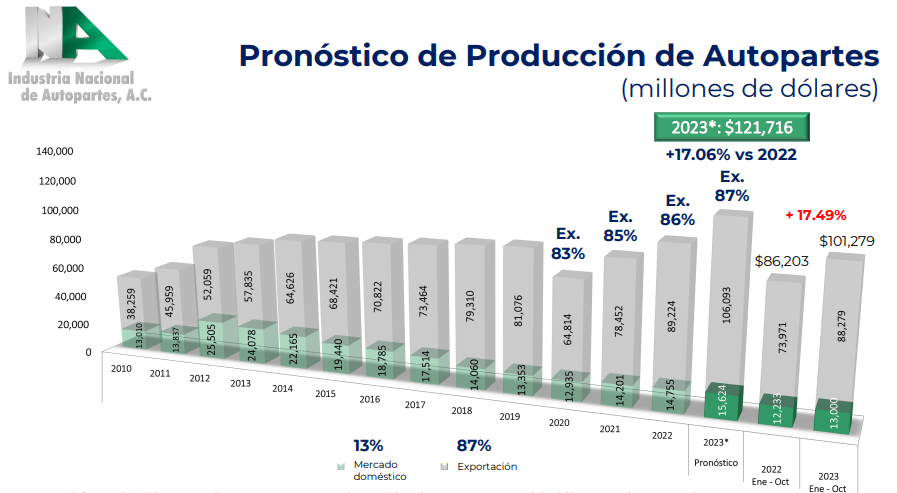

Auto parts production in Mexico will break a record in 2023, according to statistics and projections from the National Auto Parts Industry (INA).

With updated data as of last October, INA predicts that auto parts production in Mexico will grow 17.1% in 2023, to 121.716 billion dollars.

Within this amount, 87.2% corresponded to exports and the remaining 12.8% was sold in the domestic market.

With ongoing investments in research and development, the world’s automotive parts companies logically produce a wide variety of products including, among others, engines, brakes, transmissions, suspension systems, tires, exhaust systems, seats, electrical systems, interiors, bodywork and, increasingly, electronics.

A decade ago, in 2013, auto parts production in Mexico was US$81.913 billion, with 70.6% for export and 29.4% for the local market.

Auto parts production

Canadian auto parts company Magna International refers that the global automotive industry is a complex and high-tech manufacturing industry.

At the same time, the industry is evolving rapidly in response to social, economic and mobility-related trends, including the transition to a low-carbon economy, which is accelerating the shift from internal combustion to electric propulsion.

From January to October 2023, Mexico produced $101.279 billion worth of auto parts. How was it subdivided? For export, 87.2 percent. For the domestic market, 12.8 percent.

Automotive industry

China, Europe, North America, Japan, India and South Korea represent the world’s largest automotive production markets and account for approximately 88% of the vehicles produced worldwide.

China’s share of about 32% of global production led all markets in 2022, followed by the United States and Japan, with a 12% and 9% share, respectively.

Local demand for vehicles in China, India and certain markets outside North America and Western Europe has increased over time.

According to Magna International, this growing local demand has helped boost the local automotive industry in these countries and has attracted manufacturing investments from automakers based in North America, Europe and Asia, through independent investments and/or joint ventures with local partners.