BBVA Mexico reported a 27% year-over-year increase in net income in 2022, to Ps. 76.53 billion, the bank said in its quarterly report.

This profit was supported by the constant generation of recurring income due to the higher level of customer transactions.

In Mexico, multiple banking continues to show a high degree of concentration.

The five largest banks held 67 percent of assets in December 2021 (three of which were foreign-owned), and the 10 largest banks, 83.4 percent.

The top five commercial banks by asset size are: BBVA Mexico (22.15 percent of total assets), Santander (14.81 percent), Banamex (12.43 percent), Banorte (11.16 percent) and HSBC (6.45 percent).

BBVA Mexico

BBVA Mexico’s estimated capitalization ratio stood at 19.2% at the end of December 2022, comprised of 16.8% core capital and 2.4% supplementary capital.

Despite the complex environment, BBVA Mexico maintains comfortable liquidity levels to continue growing.

The liquidity ratio, defined as stage 1 and 2 loan portfolio, between demand and time deposits, stood at 92.1% and the short-term indicator, defined as Liquidity Coverage Ratio (LCR), stood at 197.68%.

The company is a corporation authorized to operate as a commercial bank.

BBVA México is present throughout the Mexican Republic, serving its customers through a wide network of branches and other distribution channels such as ATMs, banking correspondents, point-of-sale terminals, internet, digital channels, among others.

In addition, the bank has specialized executives for each customer segment, who provide a differentiated and personalized service to individuals, companies and government entities.

As of December 31, 2021, BBVA Mexico offered products and services to 25.3 million customers.

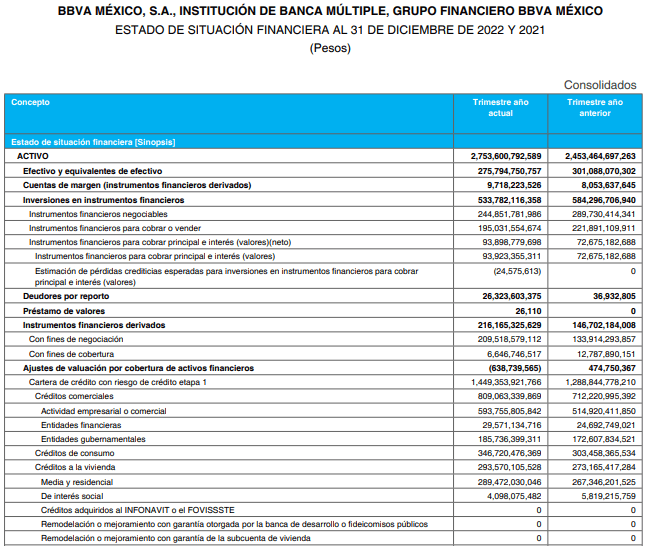

In addition, the company recorded total assets of Ps. 2,453,465 million, deposits of Ps. 1,560,791 million and stockholders’ equity of Ps. 282,668 million.

For the year ended December 31, 2021, its net income was 60,260 million pesos. Previously, this indicator showed the following trend: in 2019 (Ps. 49,254 million) and in 2020 (Ps. 36,167 million).

Based on assets, loans and deposits, BBVA Mexico was the largest bank in the country based on information published by the CNBV as of December 31, 2021.