Tier 1 and 2 auto parts manufacturers have very large supply chains to meet a wide variety of high-tech needs for their processes, highlights a report from the US Department of Commerce.

Those companies are building automotive assemblies and systems at locations in Canada and around the world.

The largest of these, Magna International, is one of the world’s leading manufacturers and also assembles complete vehicles for companies such as Mercedes, BMW, and Chrysler (not in Canada).

Data from the United States Census Bureau shows that Canadian exports of auto parts to the United States markets were 14,989 million dollars from January to November 2021, an increase of 18.6% compared to the same period of the previous year.

But if that same amount is compared to the same period in 2019, before the Covid-19 pandemic, Canada’s auto parts sales to its southern neighbor registered a 3.7 percent drop.

There is also a very strong industry organization, the Automotive Parts Manufacturers Association (APMA).

For the Department of Commerce, high-tech clusters are significant opportunities.

For example, one of them is the autonomous vehicle group Kanata North Business Association.

Already several Canadian local authorities are developing related programs.

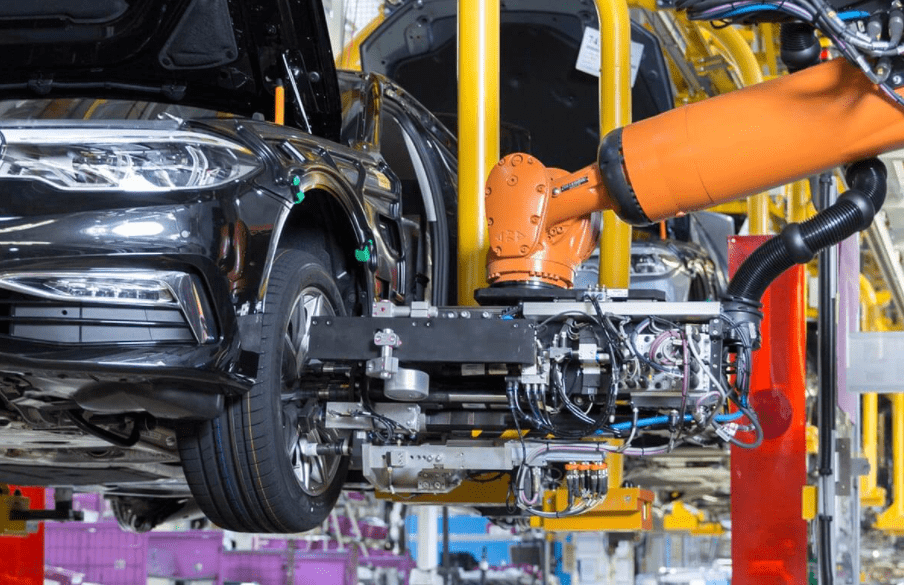

Auto parts

The Canadian government has a goal of carbon neutrality by 2050 and has allocated large investment resources in the 2021 budget for infrastructure and a green economy.

According to the Department of Commerce, the Canadian subsidiaries of US automakers announced investments to prepare their production lines for electric vehicles: General Motor, 785 million dollars; Ford, 1.5 billion, and Chrysler, 1.14 billion.

Furthermore, a large number of market players are preparing for this trend and represent significant opportunities.

Canada’s Covid-19 recession was the largest since the Great Depression.

But the Canadian government’s Covid-19 economic response plan has helped engineer economic change with unprecedented speed, both relative to some of its peers and relative to previous economic downturns, including the 2008-2009 recession.

As of the third quarter of 2021, Canada’s real GDP is only 1.4% below its pre-pandemic level and is expected to reach its pre-pandemic level in the first quarter of 2022.

![]()