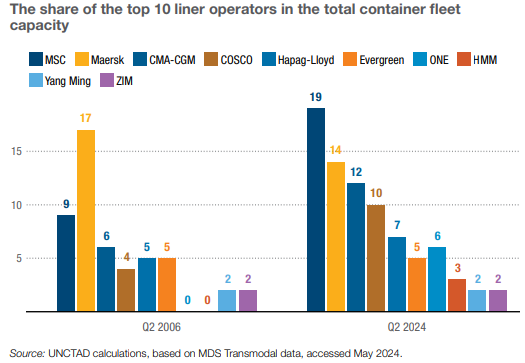

Shipping lines MSC, Maersk and CMA-CGM lead global shipping by container fleet capacity.

The rest of the top 10 companies in the industry are: COSCO, Hapag-Lloyd, Evergreen, ONE, HMM, Yang Ming and ZIM.

When comparing Q2 2006 to Q2 2024, a significant change in MSC’s share is observed. During this period, MSC’s share of total world container fleet capacity increased from 9% to 19%. These data come from the United Nations Conference on Trade and Development (UNCTAD).

In the same comparison, Maersk’s share fell from 17 to 14 percent and CMA-CGM’s share increased from 6 to 12 percent.

The cargo shipping industry is highly competitive, with the top three carriers in terms of global capacity (MSC, Maersk and CMA CGM) accounting for approximately 46.7 percent of global capacity, and the other carriers together contributing less than 53.3 percent of global capacity as of December 2023, according to Alphaliner.

Container fleet

The decisions by Mediterranean Shipping Company (MSC) and Maersk to end their 2M alliance in 2025 have led to some changes in the market.

In its Shipping Review 2024, UNCTAD sets out that new patterns are emerging in the way liner services are organized and how capacity is used.

On the one hand, members of the 2M alliance appear to have begun to separate their operations prior to this planned split, although this trend has recently been reversed.

From UNCTAD’s perspective, this recent change may well reflect renewed collaboration, possibly triggered by the disruption in the Red Sea and the resulting capacity shortage.

Shipping lines

MSC and Maersk have recently increased capacity independently.

In early 2024, Maersk and Hapag-Lloyd announced “Gemini,” a new cooperation agreement.

The plan seeks to improve reliability to 90%. This will be achieved as of February 2025. To this end, they will offer more efficient services. In addition, there will be fewer stops on main lines.

The measures will be combined with a strong network of shuttles, which will be connected to inland operations, using the central terminals.

For UNCTAD, it will be important to closely monitor how these developments affect trade, freight rates, terminals and competition, as well as connections between ports using the hub-and-spoke network.