Major disruptions in maritime trade in 2023 and part of 2024 have highlighted the Panama Canal and the Red Sea.

Canada’s Office of the Chief Global Affairs Economist highlighted these events in a report on trade and supply chains.

The global trade and investment landscape encountered obstacles such as increased protectionism, maritime disruptions such as those in the Panama Canal and the Red Sea, and geopolitical tensions.

As a result, Foreign Direct Investment (FDI) flows reached $1.33 trillion in 2023. This represents a year-on-year drop of 2 percent.

In addition, the volume of world trade decreased by 1.2 percent in 2023, following a 3.0 percent increase in 2022.

On the other hand, global economic growth slowed from 3.5 percent in 2022 to 3.2 percent in 2023.

Disruptions in maritime trade

The Office of the Chief Economist has pointed out that, thanks to the size of modern ships, shipping is cheaper. This is due to the creation of key infrastructure and the dominance of container shipping.

In fact, efficiency in international shipping has driven the growth of supply chains. Today, more than 80% of globally traded goods travel by water. This equates to more than $20 trillion by 2023.

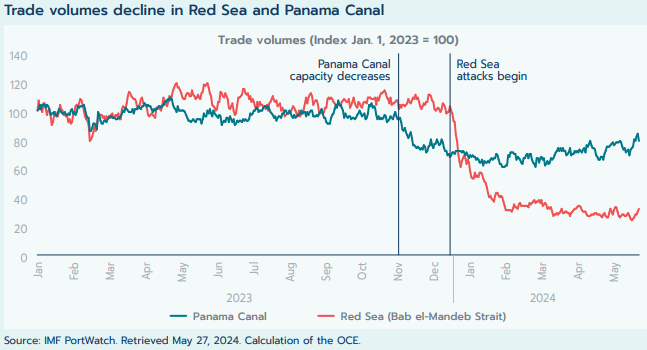

However, recent events have highlighted factors negatively affecting maritime trade. For example, historic drought conditions in the Panama Canal have forced authorities to implement transit caps.

The number of ships transiting the canal dropped from an average of 36 to just 18 in February 2024, according to Panama Canal Authority data.

Logistics

Although the number of ships has increased since then, the canal operated well below capacity for more than four months. As of March 2024, it was operating at approximately 70% of capacity.

As a result, trade volumes in the Panama Canal were 32% lower in the first two months of 2024 compared to the same period in 2023.

Meanwhile, in the Red Sea, 2023 ended with attacks on ships by a Yemeni militant group. This resulted in a 59% drop in trade volumes in the first two months of 2024 compared to 2023. As of May 2024, trade volumes on both transit lanes remained stagnant.

The Panama Canal and Red Sea routes account for approximately 20% of world seaborne trade. Therefore, finding alternative routes or modes of transport can be costly. For example, the next best option for ships traveling from Asia to Europe is to round the southern tip of Africa. This can add another week or two to transit times.

Outlook

The market size of the global shipping industry has grown considerably in recent years. This growth is due to the increase in seaborne trade and shipping demand. The total market size increased from 1,931.7 million deadweight tons (DWT) in 2018 to 2,198.0 million DWT in 2022.

This represents a Compound Annual Growth Rate (CAGR) of 3.3% during that period. As commercial maritime activities recover from the Covid-19 pandemic, the market is expected to increase to 2,539.3 million DWT in 2027. This will imply a CAGR of 2.9% from 2023 to 2027.