World trade has recovered along with world economic activity, highlighting durable goods, said a World Bank report released on Tuesday.

First of all, the recovery has been swift for trade in goods.

Trade in services has strengthened; however, it still lags behind, with travel services particularly moderate.

In particular, reduced tourism flows have weighed on activity in tourism-dependent economies, including many small island developing states.

At the same time, according to the World Bank, the recovery in world trade has reflected a shift in global demand towards trade-intensive manufactured goods, especially durable goods.

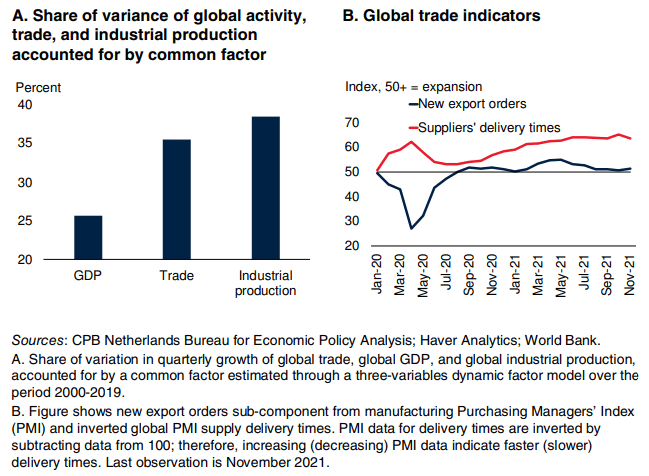

Increases in industrial production have been reflected almost one by one in strong trade growth, in line with historical evidence that they are driven by a common factor.

Significant stresses in global supply chains emerged in 2021; However, they appear to have been caused primarily by factors that are likely to be temporary, including pandemic-related port and factory closures, weather-induced logistics bottlenecks, and an acute shortage of semiconductors and shipping containers.

World trade

Likewise, bottlenecks that have propagated through global supply chains have led to a surge in the backlog of orders for traded goods and to recordhigh shipping prices, which at their peak in October 2021 were six times their 2019 levels.

Meanwhile, inventories have been depleted by companies looking to meet the pickup in demand.

The report states that supply chain tensions may be easing slightly, as suggested by the recent slowdown in delivery times for supplies and the drop in shipping prices in November.

After hitting a 9.5% rise in 2021, the World Bank expects the rise in world trade to slow to 5.8% in 2022 and 4.7% in 2023, as demand moderates.

«International travel is likely to remain subdued in the short term, but to recover gradually over the forecast horizon, supported by improvements in international mobility as vaccination progresses,» the Bank said.

Downside risks to the global trade outlook include, in the short term, a worsening of supply bottlenecks due to the increase in the Omicron pandemic and, in the longer term, increased protectionism.

![]()