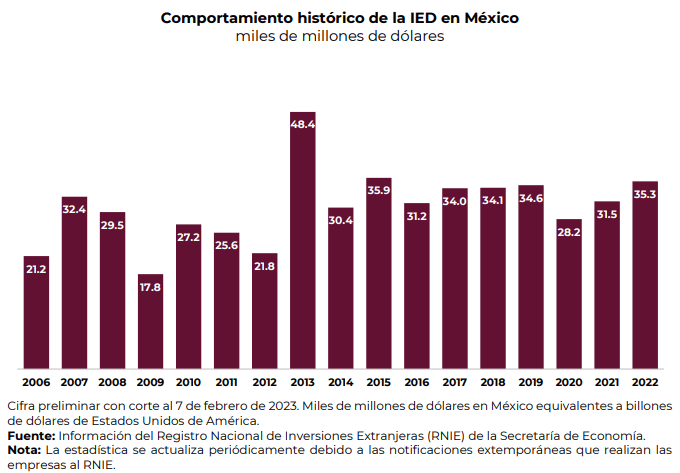

Mexico 35.292 billion dollars of Foreign Direct Investment (FDI) in 2022 which represents an increase of 12% over 2021, informed the Ministry of Economy.

Previously, during the 2016-2021 period, annual FDI flows remained above US$30 billion.

During 2021, an increase in FDI flows was observed over 2020, according to preliminary data.

The main FDI recipient sectors during the 2016-2021 period were manufacturing industries, followed by financial and insurance services, trade, transportation, mining and power generation.

In terms of the origin of FDI flows from 2016 to 2021, the main investing countries are the United States, which continues to lead the list with 47.5 percent of FDI in 2021, followed by Spain (13.7 percent) and Canada (6.5 percent).

Now, of the FDI reported in 2022, 48% corresponds to new investments in Mexico; 45% to reinvestment of profits and the remaining 7% intercompany accounts.

FDI in Mexico

Mexico’s investment regime has not changed substantially in the last five years.

This regime is regulated by the Constitution (Articles 25, 27 and 28) and the Foreign Investment Law (LIE) and its Regulations.

The National Foreign Investment Commission (CNIE) issues General Resolutions defining the criteria for the LIE and its Regulations.

In 2022, Mexico had 30 Agreements for the Promotion and Reciprocal Protection of Investments (APPRI); 12 free trade agreements with investment clauses; 1 Investment Cooperation and Facilitation Agreement (ACFI); and 60 double taxation agreements.

Mexico participates in the Convention Establishing the Multilateral Investment Guarantee Agency (MIGA) and, since 2018, in the Convention on the Settlement of Investment Disputes between States and Nationals of Other States (ICSID Convention).

Mexico does not apply exchange restrictions or restrictions to repatriate what is invested or pay profits, dividends, interest and royalties abroad. However, remittances, including the payment of dividends and profits and any type of earnings, are subject to a tax.

As negotiated in the APPRI and trade agreements, Mexico may temporarily limit transfers abroad to maintain balance of payments equilibrium.