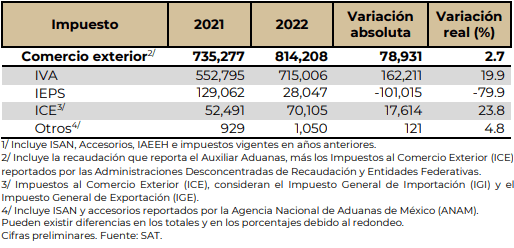

Foreign trade contributions to Mexico‘s tax collection in the first nine months of 2022 showed a 2.7% real annual growth, according to data from the Ministry of Finance and Public Credit (SHCP).

Within that figure, the increase in VAT collection (19.9% real) stood out, that is 162,211 million pesos more than what was reported in the same period of 2021.

Foreign trade contributions to Mexico

However, IEPS collection was affected with a real decrease of 79.9%, due to the fiscal stimuli of the IEPS on fuels to maintain fuel prices in the domestic market, as well as the smuggling of these energies.

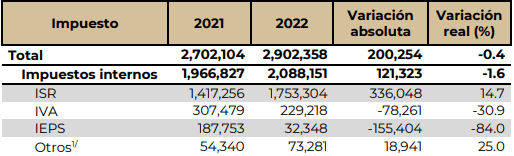

As of the third quarter of 2022, domestic contributions comprised 72% of tax revenues, with 2 trillion 088,151 million pesos.

Compared to the same period of the previous year, these decreased 1.6% in real terms due to fiscal stimuli to maintain fuel prices.

In contrast, the ISR showed greater dynamism due to the payment of the ISR of legal entities, which increased collection by 336 billion pesos.

As for VAT, its drop is explained by the increase in refunds, which does not reflect the economic reality since, methodologically, both domestic and foreign trade refunds decrease in domestic contributions.

As of September 2022, ISR from withholdings reached 877,842 million pesos, that is, 50.1% of total ISR collection, while 48.9% (856,728 million pesos) corresponded to ISR from profits of individuals and corporations. The remainder came from ISR on other income (18,734 million pesos).

Contribuciones internas y de comercio exterior Enero-septiembre (Millones de pesos)

Collection

In January-September 2022, 2 trillion 902.4 billion pesos were collected, which implies a decrease of 0.4% in real terms and an increase of 200.3 billion pesos more than in the same period of the previous year, in nominal terms.

These additional revenues are the result of the continuity of collection and auditing strategies to strengthen tax collection, as well as the country’s economic reactivation.

With respect to the Federal Revenue Law 2022 (Ley de Ingresos de la Federación 2022, LIF 2022), 97.4 percent compliance was achieved.

In particular, the ISR presented a growth of 14.7 percent in real terms, with a collection of 1 trillion 753.3 billion pesos, an amount 336 billion pesos higher than that recorded in the same period of 2021.