Global total and refined copper consumption will grow at a compound annual growth rate of 2.4% and 2.2%, respectively, between 2022 and 2032, according to Wood Mackenzie projections.

This trend is increasing pressure on producers to advance the next stage of projects.

Wood Mackenzie predicts that copper’s importance will grow even further due to decarbonization and the global push for a greener economy.

However, the anticipated rise in demand for raw materials following China’s easing of COVID-19 restrictions in December 2022 has been weaker than expected.

According to the World Trade Organization (WTO), this slowdown has significantly impacted minerals and metals. China’s demand accounts for around half of the global demand in this sector.

The decline in metal prices observed from May 2022 to May 2023 is closely tied to financial difficulties in China’s real estate sector. This sector drives a substantial share of global demand for industrial metals.

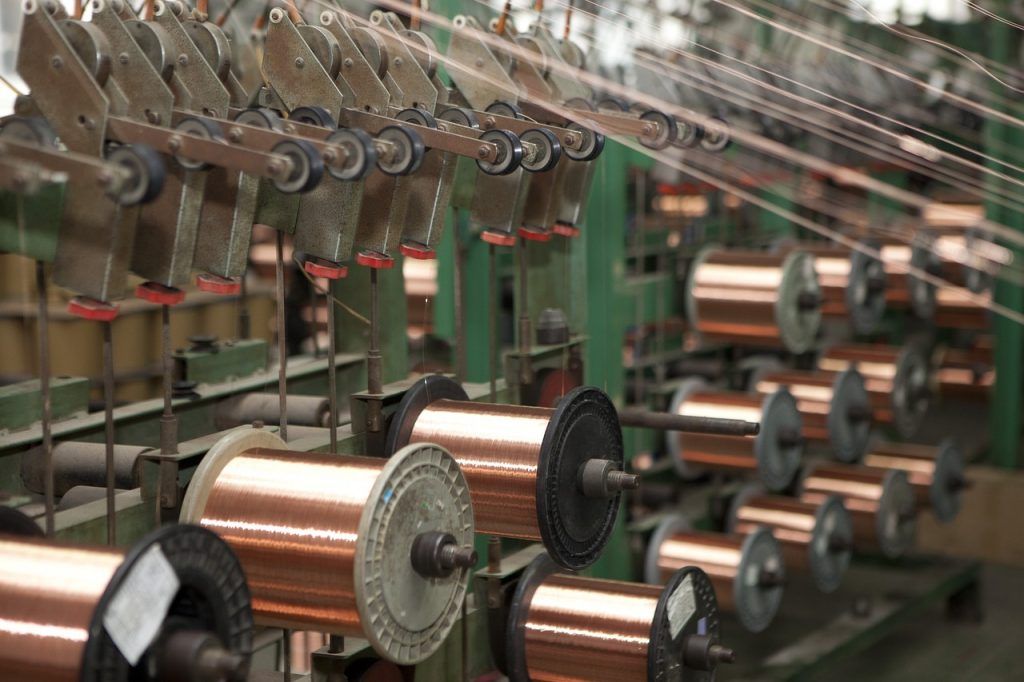

Copper

To partially offset this comparative shortfall in demand, the Chinese authorities have engaged in heavy government spending on infrastructure projects.

The WTO reports that this has helped sustain demand for commodities such as copper and iron ore, whose price declines of 12 percent and 20 percent, respectively, would have been much steeper without the increase in global demand caused by this spending.

In one of its main uses, copper is needed for electrification and equipment manufacturing.

According to Ivanhoe Electric Company, in developing areas, copper consumption occurs mainly in the form of infrastructure construction and the manufacture of equipment and electronic products.

In developed areas, consumption is often driven by infrastructure replacement or upgrades and equipment manufacturing. The drive towards electrification increases demand for copper as a result of increased power generation, transmission and consumption.