The global nuclear power industry continues to grow strongly, with 69 new reactors connected to the grid since 2013 and another 59 reactors under construction as of August 2023, according to data from PRIS and WNA.

Moving forward, the International Energy Agency projects more than doubling nuclear generation by 2050, with at least 30 countries increasing their use of nuclear power, in the Net Zero Emissions by 2050 scenario of its latest World Energy Report.

Also, according to Uranium Energy Corp, additional upward pressure is emerging in the market as utilities return to a longer-term contracting cycle to replace expiring contracts; something the market has not experienced for several years.

At the same time, there has been growing demand from financial entities and several producers, including Uranium Energy, which purchased significant amounts of uranium inventory in drums, further eliminating near-term oversupplies.

In recent years, global uranium market fundamentals have been improving as the market shifts from an inventory-driven market to a production-driven market.

Uranium Energy refers that the spot market bottomed in November 2016 at approximately $17.75 per pound U3O8 and stood at 56.25 per pound on July 31, 2023 (daily spot price UxC U3O8).

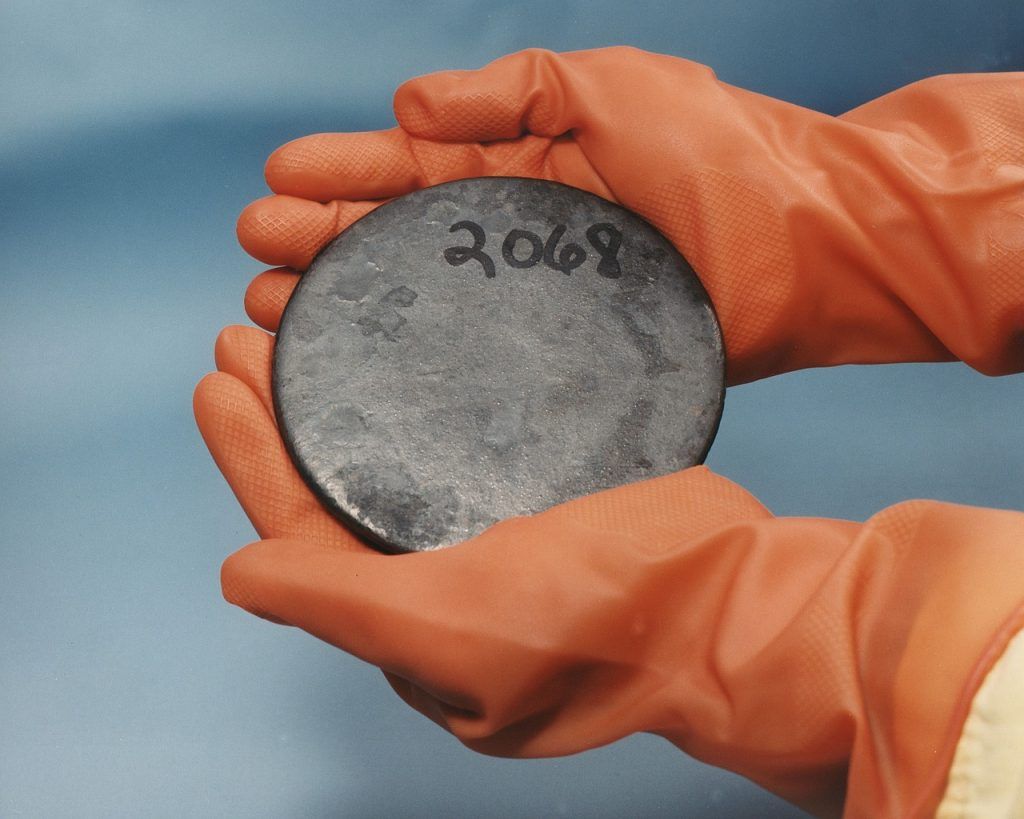

Nuclear power

Production then fell to a multi-year low in 2020, around 122 million pounds, but began to recover in 2021 and totaled around 129 million pounds in 2022, still well below reactor requirements.

Global supply and demand projections show a structural deficit between production and utility requirements that will average more than 44 million pounds per year over the next 10 years and increase thereafter, according to UxC 2023 Q2 Uranium Market Outlook.

The current gap is being filled by secondary market sources, including finite inventory that is projected to decline over the next few years.

As secondary supplies dwindle and existing mines deplete their resources, new production will be needed to meet utility demand.

From Uranium Energy’s perspective this will require higher prices to stimulate new mining investment, but market prices are still below incentive prices for many producers.