To ensure supply, Grupo Bimbo, the world’s largest bakery company, has entered into wheat hedging contracts in an environment of wheat uncertainty.

Grupo Bimbo purchases large quantities of raw materials, such as wheat flour, edible oils and fats, sugar, eggs and plastics used in the packaging of its products.

The prices of these raw materials are subject to fluctuations.

In particular, wheat flour is the company’s main raw material, and the company reviews its relationship with its main suppliers on an ongoing basis.

Wheat is generally traded in U.S. dollars and is subject to price fluctuations based on factors such as weather, crop production, and supply and demand in the world market, among others.

On an ongoing basis, therefore, Grupo Bimbo enters into hedging agreements to manage its exposure to price fluctuations and ensure the timely supply of its main raw materials.

Grupo Bimbo

In parallel, the company maintains strategic alliances with research centers such as the International Maize and Wheat Improvement Center (CIMMYT) and recognized institutes such as the Whole Grains Council, the Consumer Goods Forum and the International Food and Beverage Alliance (IFBA).

In addition, the Health and Wellness action platforms are aligned with those defined by the World Health Organization (WHO) to adopt internationally recognized strategies and best practices.

Grupo Bimbo participates in the Access to Nutrition Index (ATNI), which evaluates the strategy of the world’s leading food and beverage producers with respect to their nutrition-related commitments, practices and performance.

The company, through one of its subsidiaries, acquired on October 26, 2021 100% of the shares of Kitty Industries Private Limited, a company that operates in India and is engaged in the production, distribution and sale of white, whole wheat, wheat and fruit bread, among other products.

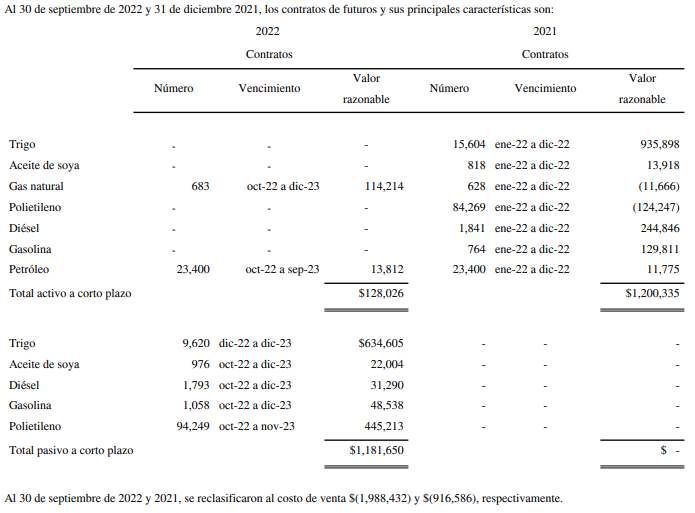

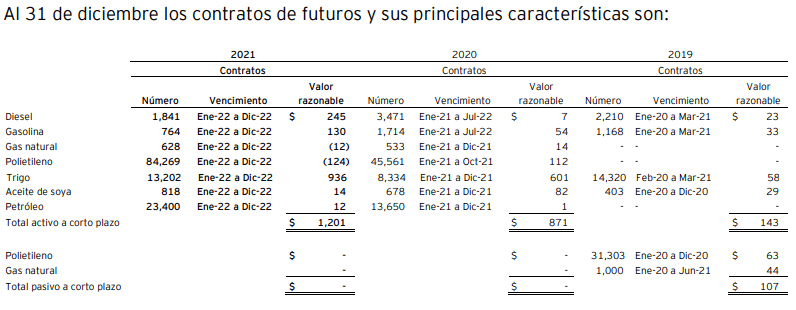

Grupo Bimbo, in accordance with its risk management policies, enters into futures contracts for wheat, natural gas and other inputs in order to minimize the risk of variations in the international prices of these inputs.

Contracts

The company performs retrospective and prospective effectiveness measurements to ensure that the instruments used mitigate exposure to variability in cash flows from fluctuations in the price of these inputs.

As of September 30, 2022 and December 31, 2021, the company has recognized in comprehensive income closed wheat derivative contracts, which have not been applied to cost of sales.

![]()