The National Council of the Maquiladora and Export Manufacturing Industry (Index) questioned the Mexican government’s intention to charge VAT to IMMEX companies.

“We express our surprise at the SAT’s proposal of a double tax collection measure, which will be analyzed by the Supreme Court of Justice of the Nation (SCJN) starting next Thursday, February 27,” said the Index.

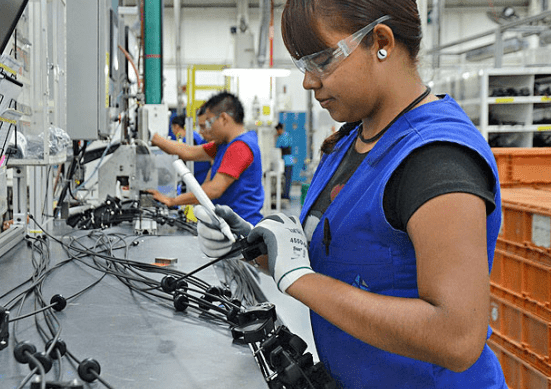

IMMEX

To understand this case, Luis Mancera, partner of Pérez-Llorca who leads the Administrative and Foreign Trade areas, and Félix Ponce-Nava, counsel of Pérez-Llorca in the Foreign Trade area, explained that the debate in the SCJN on the maquiladora sector and the IMMEX Program is part of a broader discussion on the balance between public policy to promote foreign trade and the fiscal sustainability of the country.

According to them, Mexico faces a double challenge: consolidate its position as a strategic partner of the United States and diversify its exports, while resolving the fragility of its tax base.

Informality in several sectors not included in the taxpayer base limits the SAT’s collection capacity and forces it to seek additional income through temporary measures that sometimes “conflict” with policies to promote investment and the maquiladora sector.

“This dissonance generates uncertainty, since the change in the rules of the game in fiscal aspects with retroactive effects affect the economic stability and legal security of companies, and can undermine Mexico’s competitiveness in the global supply chain,” they said.

Index

In a press release, the Index said it has been a major driver of the creation of the SAT rule for virtual operations with V5 key.

The SAT has stated that maquiladora companies are improperly using virtual operations with V5 code to avoid paying VAT, since, in their opinion, they would be simulating the return of goods that are in national territory to the detriment of the tax authority.

The SAT estimated that these operations totaled 279,000 million pesos between 2019 and 2023, on which it intends to charge IMMEX companies 44,640 million taxes that, according to its criteria, they did not withhold.

“We consider it difficult to conceive that legally, the Legal Fiction does not have full legal effects -including fiscal ones- since the cornerstone of the facility contained in the Rule lies in that legally the exported merchandise is virtually at all times outside the national territory until it is introduced or imported in a definitive manner by importers using the pedimento with key V5”, said the Index.

As background, on October 5, 2023, the North Central Regional Chamber of the Court of Administrative Justice established a binding jurisprudential criterion, determining that there is no obligation to withhold VAT on the acquisition of imported goods sold by a foreign resident without a permanent establishment in Mexico, when a pedimento with code V5 is used.

Subsequently, on February 23, 2024, the Mexican Supreme Court of Justice issued a ruling in favor of the nature of virtual transactions, declaring that such sales must be considered to be made outside Mexico, and therefore the obligation to withhold VAT from a foreign resident without a permanent establishment in Mexico is not applicable to virtual export transactions with V5 pedimentos.

Controversy

“Unfortunately, what was originally created to avoid taking out or returning goods produced by the maquiladoras abroad (United States), to immediately re-import a portion for consumption in Mexico, ended up becoming a mechanism that some SAT auditors intended to take advantage of with different criteria to use this mechanism of V5 pedimentos as a super tax collection measure, charging VAT twice,” added the Index.

In the opinion of the Index, the VAT Law itself supports this precept, of not charging VAT twice, when it states (second paragraph of Article 1-A of the VAT Law): “Individuals or legal entities that are obligated to pay the tax exclusively for the importation of goods shall not withhold the VAT [for alienation] referred to in this article”.

So virtual importers of pedimentos with V5 code are obligated exclusively to the payment of VAT on importation.

“Clearly this paragraph of the VAT Law FAIRLY mandates NO DOUBLE payment of VAT. In other words, if you pay it on importation you do not pay it on disposal. The spirit of the VAT Law (2nd paragraph, Art. 1-A) and the intention of the legislator is clear, simple, fair and reasonable. We hope that the Supreme Court honors the spirit of the law… Do not charge double VAT,” said the Index.