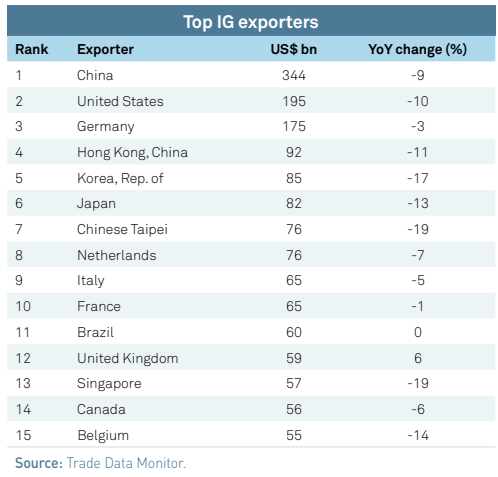

China and the United States led exports of intermediate goods in the second quarter of 2023, according to data from the World Trade Organization (WTO).

While Chinese external sales were $344 billion in those three months, a year-on-year decline of 9 percent, corresponding U.S. sales totaled $195 billion, a drop of 10 percent.

This was followed by Germany with a 3% decline to $175 billion.

Intermediate goods exports from Singapore and Chinese Taipei were down 19 percent year-on-year in Q2 2023, following declines that began in late 2022 and extended through 2023.

High-tech components, such as integrated circuits, memory chips and microprocessors, contributed most to the decline in both economies, reflecting weak consumer demand due to high inflation and high interest rates.

Meanwhile, exports of intermediate goods from the Republic of Korea (-17% year-on-year) were similarly affected by the fall in global demand for IT products.

Although most members of the European Union did not experience large reductions in trade in intermediate goods, Belgian exports of these products fell by 14% year-on-year.

Since mid-2022, the economy reduced its exports of chemical compounds and semi-manufactured metal products essentially to its European Union partners.

Intermediate goods

In the second quarter of 2023, an unprecedented volume of soybeans was exported from Brazil to Argentina.

Despite being a major producer, Argentina became the second largest importer of soybeans from Brazil, with purchases worth $1.3 billion, up from zero a year earlier.

The sharp increase in imports was triggered by the halving of soybean production in Argentina following a drought and combined with a continued need for soybeans in the Argentine agricultural industry for the production of oils and meals to meet contractual agreements.

In the second quarter of 2023, regional supply chains in Asia and Europe accounted for more than half of global intermediate goods trade, 27% ($606 billion) and 28% ($629 billion), respectively.