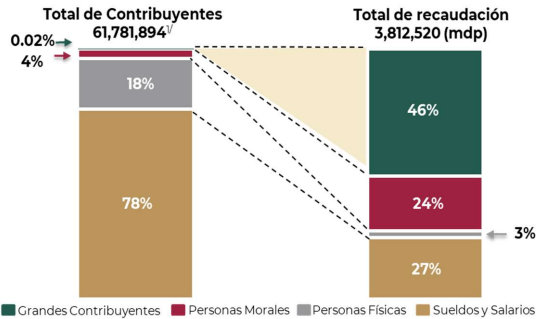

Large taxpayers (legal entities) in Mexico represent 0.02% of the taxpayer registry, according to data from the Ministry of Finance and Public Credit (SHCP).

Of the total number of active taxpayers with tax obligations last year, 96% correspond to individuals (78% to wages and salaries and 18% to the rest) and 4% to legal entities.

In particular, the contribution of the Large Taxpayers segment amounted to 1,759,428 million pesos, which represented 46% of total tax revenues.

Large Taxpayers withhold Value Added Tax (VAT) from the taxed goods and services they sell, which is paid by consumers, to be subsequently paid to the Tax Administration Service (SAT).

As of 2022, the collection of the new Simplified Trust Regime (RESICO) is recorded, which, as of December 2022, is Ps. 28,842 million.

Distribución del padrón y recaudación por régimen, enero-diciembre 2022.

Specifically, in the case of Large Taxpayers, for those companies with VAT and Special Tax on Production and Services (IEPS) Certification, refunds are resolved, depending on the type of certification, between 4.03 and 9.50 business days, while for those without such certification the term is around 22.31 business days.

For both taxes, article 22, seventh paragraph of the Federal Tax Code establishes a term of 40 business days to carry out the refunds, in practice, for Large Taxpayers this term is reduced to 22.31 business days on average.

Large Taxpayers

The continuity of the Large Taxpayers audit program resulted in the collection of 233,270 million pesos.

Although voluntary compliance is preferred to enforcement actions, additional efforts have not been relaxed, so that in 2022, 1,029 Large Taxpayers were audited, this is 80.8% more than in 2018.

For the remaining taxpayers, the strategy focuses on the execution of acts in substantive methods, in order to maintain a high level of effectiveness in the acts performed and in achieving higher secondary collection.

In 2022, a collection of 188,821 million pesos was achieved, of which 64,179 million pesos correspond to acts of foreign trade control; through which evasive behaviors are identified in real time in the sectors of greatest risk (automotive; steel; textile and apparel; electronics; wines and spirits; among others), as well as in the constant monitoring of taxpayers operating under special trade programs.

![]()