Oil production in the world has fallen in part due to the transition to clean energy, highlighted the Central Bank of the Netherlands (DNB).

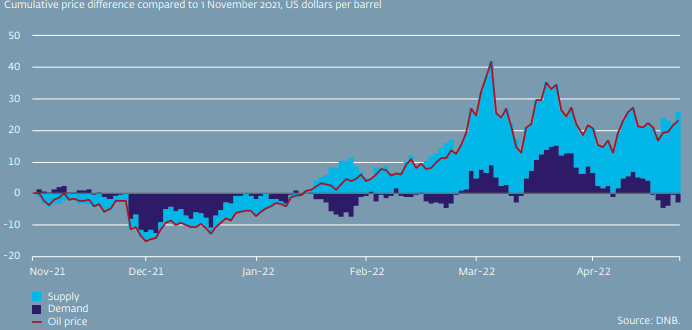

An analysis by this bank shows that the increase in the price of oil in the first quarter of 2022 was mainly due to supply effects.

For example, oil supply had not yet sufficiently recovered from production disruptions caused by the pandemic, while investments in oil production have structurally declined due to the transition to sustainable energy sources.

This tightness in the oil market further increased in February due to concerns about Russian oil supply following the invasion of Ukraine and subsequent Western sanctions.

Decomposition of oil price movements by supply and demand

However, the tightness in the oil market eased in March, causing the price of oil to drop.

The DNB added that this decline is mostly due to weaker demand, partly as a result of an (expected) slowdown in growth in China.

Oil production

Another factor is the increase in supply following the decision of the United States and other members of the International Energy Agency to release part of its strategic oil reserves to the market.

Since the end of April, the price of oil has risen again, partly fueled by the prospect of a European embargo on Russian oil.

At the same time, high oil price volatility has (temporarily) undermined the functioning of the oil market.

When volatility is higher, for example, it is more expensive for investors to trade oil futures due to daily offsetting of price differences from open positions.

This increases the risk of margin calls, where traders have to deposit money to maintain their position.

Meanwhile, high volatility means that closing new positions requires more capital (initial margin).

Central counterparties (CPPs) reduce counterparty risk by preventing the default of one commodity trader from causing problems for others.

![]()