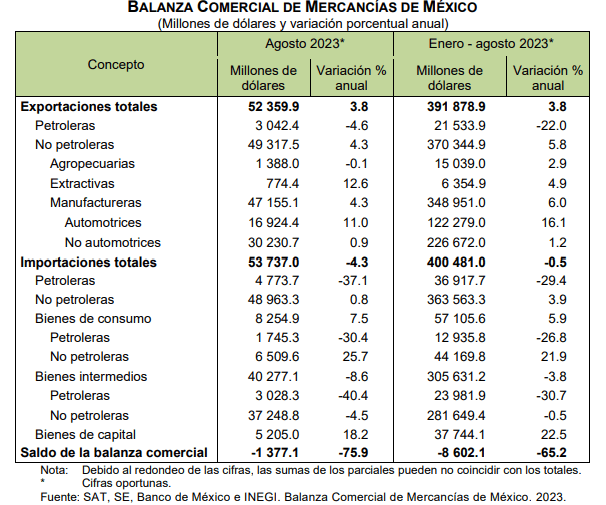

Mexico‘s automotive exports grew at an interannual rate of 11% in August, to 16,924.4 million dollars, informed Inegi.

In contrast, Mexico’s foreign oil sales fell 4.6% at an annual rate, totaling 3,042.4 million dollars.

In the total sum, Mexico’s product exports were 52,359.9 million dollars, which represents an increase of 3.8% over August 2022.

From January to August of the current year, automotive exports totaled 122.279 billion dollars, which was 16.1% higher compared to the same period last year.

Meanwhile, foreign oil sales accumulated 21,533.9 billion dollars, which is 22.0% lower at an annual rate.

Between 2018 and 2022, total vehicle production in Mexico fell 19.7% (808,000 vehicles), with a decrease of 20.8% (830,000 vehicles) between 2019 and 2020.

Nissan recorded the largest decline by value and percentage change with 386,000 vehicles (52.7%) from 2018 to 2022, followed by Stellantis with 224,000 vehicles (35.1 percent).

Automotive Exports

Production in the Mexican automotive industry declined due to production shutdowns related to the onset of the Covid-19 pandemic.

In addition, the global semiconductor shortage led Mexican automotive producers to shut down production at key plants in 2021, causing a further decline in output.

From 2018 to 2020, the mining sector showed a general trend of declining production.

However, in 2021, mining sector production recorded a moderate increase, driven mainly by oil and gas extraction, partially offset by an event that occurred during the third quarter of 2021 at the E-Ku-A2 platform, which caused damage to compression equipment and infrastructure needed to handle and transport natural gas.

In 2022, production in the mining sector continued to grow moderately.

For several decades, Mexico’s foreign trade policy has focused on the elimination of foreign trade barriers, which has resulted in an increase in Mexican non-oil exports and has led to a greater importance of manufactured products relative to agricultural products.