Mexican imports of capital goods grew 7.06% quarterly in March, accumulating 11 consecutive quarters of growth at a quarterly rate, referred Banco Base.

Although there is a significant lag in gross fixed investment of 7.06% with respect to its historical maximum, the lag in imported machinery and equipment investment with respect to the maximum is 2.97% and the maximum was reached in October 2022.

Capital Goods

In fact, as of January, investment in imported machinery and equipment shows a growth of 28.32% with respect to pre-pandemic levels (February 2020).

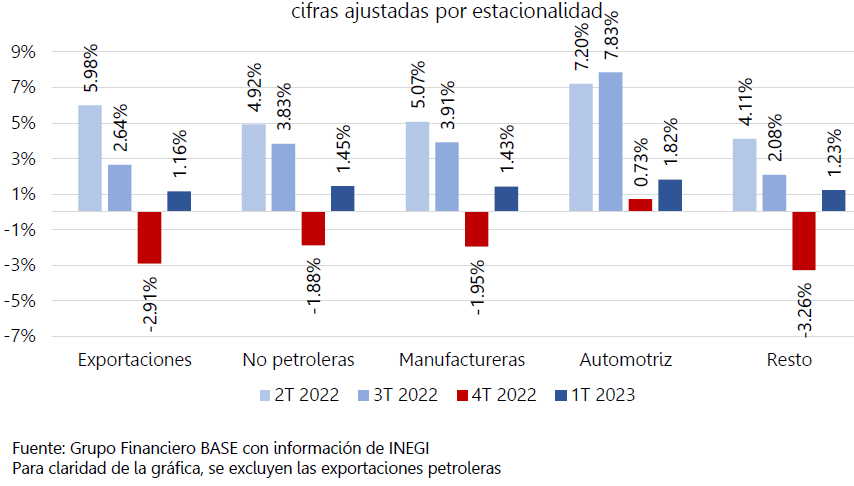

Crecimiento trimestral de las exportaciones

Internally, imports of consumer goods showed a quarterly rebound of 19.91% after falling 16.48% in the last quarter of 2022.

Finally, imports of intermediate goods contracted 1.85% quarter-on-quarter, accumulating three consecutive quarters of declines, which is a negative sign for industrial production.

In sum, in the first quarter total imports grew 1.58% quarter-on-quarter, after having fallen 5.82% the previous quarter.

Foreign trade

In 2022, foreign trade showed a larger trade deficit compared to the previous year due to continued normalization in global value chains, high international commodity prices in the first half of 2022, strength in U.S. industrial production in the first half of 2022, and growth in domestic demand throughout the year.

On a one-off basis, the merchandise trade balance presented a trade deficit of US$26.421 billion, higher than the deficit of US$10.939 billion in 2021.

This is due to the fact that the oil balance deficit, at 34,902 million dollars, increased by 10,268 million dollars with respect to the previous year as a result of the 37.6% annual increase in oil imports, as a consequence of the high prices of gasoline and natural gas during the first nine months of the year.

This more than offset the lower annual growth of 34.2% in oil exports due to the lower volume of Mexican crude oil exports.