Mexico‘s customs applied automatic licenses (automatic notices) to 1,041 tariff lines in 2021, according to information from the World Trade Organization (WTO).

To size that amount, two references: it represents 13.3% of the total tariff lines, while in 2016 that percentage was 8.2% of the total.

Mexico applies both automatic licenses (automatic notices) and non-automatic licenses (prior permits).

In principle, the use of one type of license does not exclude the other, i.e., both licenses may be required to import the same good.

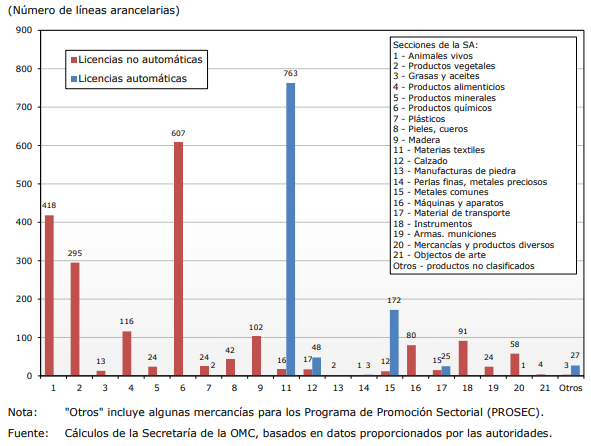

Automatic and non-automatic import licenses by HS section, 2021

The use of both licenses is due to the fact that different objectives are pursued.

While automatic licenses (automatic notices) are used to keep statistical records of imports, non-automatic licenses are used to regulate trade in specific products, in order to protect consumers, public health or the environment, regulate the importation of inputs under preferential regimes or comply with international treaties or conventions.

Automatic licenses continue to be required for the same type of products as in 2016: textiles (764 tariff lines at the 2017 HS 8-digit level), footwear (28 tariff lines at the 2017 HS 8-digit level) and base metals (iron products) (172 tariff lines at the 2017 HS 8-digit level).

Automatic licenses

When applying for a license, the import regime and tariff line, the value and quantity authorized to be imported (or exported) and the period of validity must be specified.

Licenses may have a maximum validity period of four months, depending on the product in question, and are not transferable.

Also, according to the WTO, customs may authorize one or more automatic extensions of the original import license.

The Ministry of Economy approves all applications, provided that the applicants meet the legal requirements to carry out foreign trade operations in Mexico.

In the past year, 25.2% (1,964 tariff lines of the 2017 HS at the 8-digit level) of the total tariff lines that made up the Mexican tariff were subject to non-automatic licensing requirements (prior permits) for imports.

During the 2016-2021 period, the use of non-automatic licenses apparently decreased; however, given the change in nomenclature and the elimination of tariff lines from the tariff, this cannot be stated with certainty.

Mexico continues to use both types of licenses for textiles, footwear and metals.