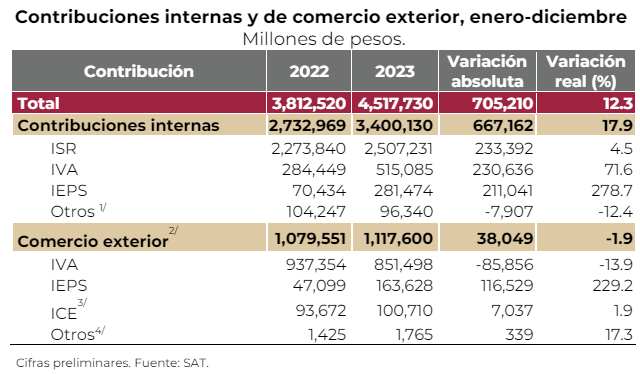

Mexico‘s fiscal contributions derived from foreign trade in 2023 totaled US$1.117.6 billion.

Comparatively, the amount is 1.9% lower than the 2022 result.

Within these contributions, 851,498 million pesos correspond to VAT, an indirect tax levied on the sale of goods and services in the country.

In second place, the Ministry of Finance and Public Credit (SHCP) obtained 163,628 million pesos for IEPS.

The IEPS is an indirect tax levied on the production and sale of certain goods and services considered «special» or «luxury».

For example, the SHCP collects the IEPS on products such as high-end vehicles, alcohol and fuels.

A third item is the Foreign Trade Tax (ICE), which includes the general import tax (IGI) and the general export tax (IGE).

The Mexican government collected 100,710 million pesos for this last tax basket.

Other contributions to external trade amounted to 1,765 million pesos.

The latter include ISAN and accessories reported by the Mexican National Customs Agency (ANAM).

Foreign trade

In 2023, imports to Mexico were US$598.475 billion, which implies a year-on-year reduction of 1%, according to Inegi data.

At year-on-year rates, VAT contributions fell 13.9%, IEPS grew 229.2% and ICE rose 1.9% in 2023.

Mexico uses an economic development model based on increasing returns from foreign trade.

To achieve this, Mexico focuses mainly on expanding its total exports through various commercial, fiscal, financial and promotional measures to grow and increase the competitiveness of its non-oil exports.

Mexico’s main advantages include its geographic position, its proximity to the United States (the world’s largest importer), the competitiveness of its labor force, natural resources and a network of trade agreements.

For several decades, Mexico’s foreign trade policy has focused on eliminating barriers to foreign trade, which has resulted in an increase in Mexico’s non-oil exports and has led to a greater importance of manufactured goods relative to agricultural products.