At the end of the third quarter of 2022, Mexico’s importers’ registry had 122,311 active taxpayers, while the sector-specific importers’ registry had 31,357 taxpayers.

Importers must be registered in the Federal Taxpayers Registry (RFC).

In addition, any individual or legal entity that carries out import operations must be registered in the Importers’ Register.

In order to import certain products (classified in 16 Chapters of the Harmonized System), it is also necessary to be registered in the Register of Importers of Specific Sectors.

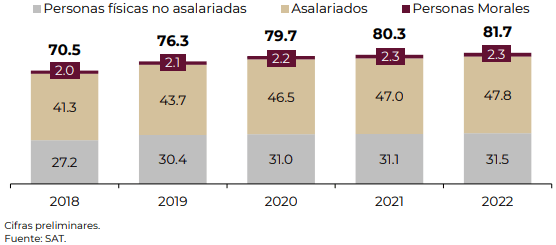

Clasificación de contribuyentes activos, enero-septiembre (Millones de contribuyentes)

The products subject to this requirement vary depending on the risk models defined by the customs authorities for each product.

However, to import goods such as orthopedic devices and some agricultural inputs and machinery, no registration is required.

Importers’ registry

The authorities believe that through these lists (registries) it is possible to exercise better control over importers, foreign trade operations and compliance with tax obligations, as well as to prevent and detect customs fraud practices, including smuggling.

Importers may be suspended from the registers in the event of noncompliance with the requirements established by customs and related regulations.

Taxpayer registry

As of September 2022, there are 81,724,225 active taxpayers, of which 61,286,078 have tax obligations.

The number of active taxpayers increased by 11 million 183,333 with respect to the same period of 2018, equivalent to an increase of 15.9% and 1.7% with respect to 2021, i.e., 1 million 375,011 more taxpayers.

Import requirements have not changed substantially in the last five years.

The customs declaration that accompanies the merchandise presented to Customs for its entry into the country (or exit from the country) must indicate the destination regime. Mexico continues to maintain six customs regimes: definitive import (export); temporary import (export); bonded warehouse; internal or international transit of goods; processing, transformation or repair in bonded warehouse; and strategic bonded warehouse.

In Mexico, it is necessary to hire the services of a customs broker, a customs agency or a legal representative, since the importer cannot directly process the customs clearance.

The customs broker, customs agency or the importer’s legal representative, who must be a Mexican national, generates the import customs declaration and submits it electronically, together with the other supporting documents.

These documents are: commercial invoice; maritime bill of lading, air waybill or transport document; and, when applicable, documents that demonstrate compliance with regulations and/or non-tariff restrictions, as well as the origin and origin of the goods in the event that preferential tariffs, countervailing duties, quotas or country of origin marking are applied.