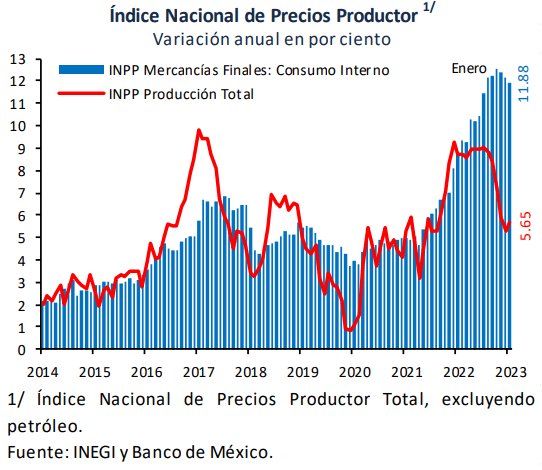

The National Producer Price Index (INPP) of total production in Mexico, excluding oil, decreased from 8.75% in the third quarter of 2022 to 6.10% in the fourth quarter, considering its average annual variation, according to the Bank of Mexico (Banxico).

It then stood at 5.65% in January 2023.

Within this indicator, the average annual variation of the merchandise and final services component decreased between the aforementioned quarters, going from 8.27% to 6.32%, standing at 5.93% in the first month of 2023.

Regarding the sub-index of export merchandise and services, its average annual percentage change decreased from 5.37 to 2.09% in the referred quarters, falling to 1.52% in January 2023.

The sub-index of prices of intermediate goods and services showed a decrease in its average annual change, going from 9.97 to 5.54% during the same quarterly period, standing at 4.92% in January.

In contrast, the annual variation of the producer price subindex of final goods for domestic consumption increased between the aforementioned quarters.

It went from 11.95 to 12.36%, while in January it stood at 11.88%, exhibiting an incipient downward trend change. This subindex is of particular relevance since it is the one with the greatest predictive power over the evolution of consumer merchandise prices, included in the core subindex.

National Producer Price Index

Between the third and fourth quarters of 2022, annual core inflation rose from 7.99% to 8.43%. In December 2022, at 8.35%, it showed a reduction after having presented an upward trajectory for 24 consecutive months.

However, in January 2023, this indicator increased to 8.45%, showing greater pressures than anticipated, and in the first half of February it registered 8.38%. Thus, it is still at high levels and does not show a downward trend. Merchandise and services inflation remained high during the fourth quarter of 2022.

This is the result of higher production costs associated with the increase in the cost of various inputs accumulated since the beginning of the pandemic.

Thus, core inflation has remained under upward pressure.

The trend of the seasonally adjusted and annualized monthly variations of the core index was still above the upper limit of the defined interval of a distance of 1.65 standard deviations with respect to its mean.

Thus, it remained at historically high levels.

Likewise, although the Truncated Mean Indicator for core inflation showed some stabilization in the reference quarter and so far in 2023, it continued to register high levels. This suggests that pressures continue to be widespread.

On the other hand, the proportion of its basket with seasonally adjusted and annualized price variations with high magnitudes is still considerable, although those with price variations greater than 10% have been decreasing since the fourth quarter of 2022.

![]()