Orbia reported a «negative quarter» from July to September 2022, interpreted Intercam Banco, in an analysis based primarily on a drop in EBITDA.

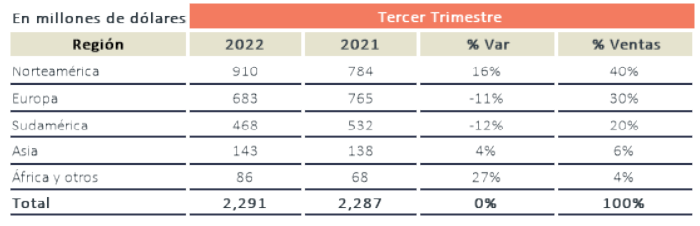

Revenues for the quarter stood at US$2.291 billion, with no growth over the previous year.

In particular, sales increased in Connectivity Solutions and Fluorinated Solutions; while its other three divisions had lower sales.

Orbia is a leading supplier of products and solutions in multiple sectors, from construction, infrastructure, agriculture and irrigation, health, transportation, telecommunications, energy, petrochemicals, among others.

The company is also one of the world’s largest producers of plastic irrigation pipes, fittings and drippers, as well as fluorspar.

Ventas por Región 3T 2022 (Todas las métricas se comparan con el 3T 2021 excepto si se indica lo contrario).

Orbia’s cost of sales in the third quarter increased 8.7%, mainly due to higher input and energy costs and higher volumes.

Likewise, EBITDA for the period was US$381 million, a 28% year-over-year decline.

Orbia

According to Intercam Banco, the drop in EBITDA was due to the devaluation of the euro against the dollar, a slowdown in demand and an increase in the cost of sales.

In addition, the margin fell 6.6 percentage points from a year ago, due to higher costs.

The same two divisions with revenue growth were those with EBITDA growth.

Figures by business group, as described by Intecam Banco:

Vestolit & Alphagary (Polymer Solutions), 34% of sales (Sales -8%, EBITDA -62%).

The decline in sales derived mainly from lower volumes due to a slowdown in demand and lower resin prices due to increased availability of lower-cost product from higher exports from China.

Meanwhile, EBITDA declined due to lower volume and cost inflation, mainly in Europe.

Wavin (Building & Infrastructure), 30 percent of sales (Sales -7 percent, EBITDA -34 percent).

Sales fell due to lower volumes, mainly in Europe, and the devaluation of the euro.

EBITDA declined due to higher input prices and lower sales, and last year was a particularly good year for the industry.

Netafim (Precision Agriculture), 10 percent of sales (Sales -17 percent, EBITDA -64 percent).

Sales of this business experienced a drop in demand in most parts of the world, except in Latin America, Turkey and China due to the rainy season and overinventory in some parts.

EBITDA also had a charge of $9 million dollars for adjustments generated by hyperinflation in Turkey.

Dura-Line (Connectivity Solutions), 16% of sales (Sales +35%, EBITDA +214 percent).

Sales growth was driven by higher prices, as well as strong demand and new fiber optic deployment projects, mainly in North America.

As a result, EBITDA benefited from the increase in sales, achieving a new record for the company for the second consecutive quarter.

Koura (Fluorinated Solutions) 10 percent of sales (Sales +30 percent, EBITDA +49 percent).

Sales growth reflected an improved product mix and price increases in all lines, both intermediates and finished products.

EBITDA expanded thanks to higher prices and a more favorable mix, which offset the increase in costs, mainly energy costs.

![]()