The Tax Administration Service (SAT) of Mexico collected 490 million dollars from TC Energy, the largest energy company in North America.

From September 2021 to February 2022, the SAT issued statements for fiscal years 2014 to 2017 that denied the deduction of all interest expenses, as well as assessed the incremental withholding tax on interest.

These assessments totaled approximately $490 million in taxes, interest, penalties and finance charges.

If the SAT continues to reassess a TC Energy subsidiary’s tax returns for subsequent years on a similar basis, there is a risk of a significant increase in the company’s exposure.

Based on recent discussions with the SAT, TC Energy believes that the areas of concern are limited to a subset of issues within these assessments.

The company has stated that it will defend its position on these assessments and will pursue all available legal tax remedies.

Based on the company’s own judgment, as well as that of outside advisors, management believes that the company’s tax position is most likely not to be sustained and no provision has been recognized in respect of this matter in the financial statements. consolidated financials.

SAT

In 2019, the SAT completed an audit of the 2013 tax return of one of TC Energy’s subsidiaries in Mexico.

The audit resulted in a tax assessment that denied the deduction of all interest expenses and an assessment of additional taxes, penalties and finance charges totaling less than $1 million.

The company disagreed with this assessment and started litigation.

In January 2022, the company received the tax court ruling on the 2013 tax return, which was in favor of the SAT.

The company believes that this decision is unreasonable and does not comply with Mexican tax regulations and will appeal this decision.

In support of the company’s position, PRODECON previously determined that the tax returns of this subsidiary were appropriate.

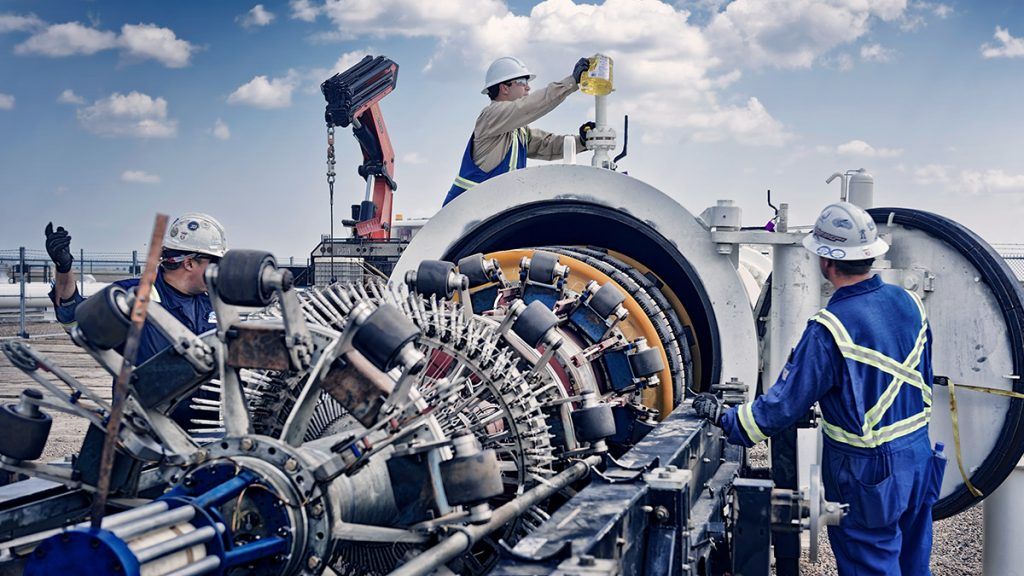

TC Energy operates three main businesses: Natural Gas Pipelines, Liquids Pipelines and Energy.

The Natural Gas Pipeline network includes 92,600 kilometers of gas pipelines, transporting more than 25% of North America’s natural gas demand.

![]()