Mexico’s Tax Administration Service (SAT) won 44% of the lawsuits in which it participated in international trade matters in the first quarter of 2022.

In the first three months of 2022, the number of favorable judgments to SAT in final judgment reached 2,427 cases, equivalent to 44.0% of the total.

In terms of the amount in controversy, the favorable rulings were equivalent to 24,421 million pesos, which represented 62.6% of the total.

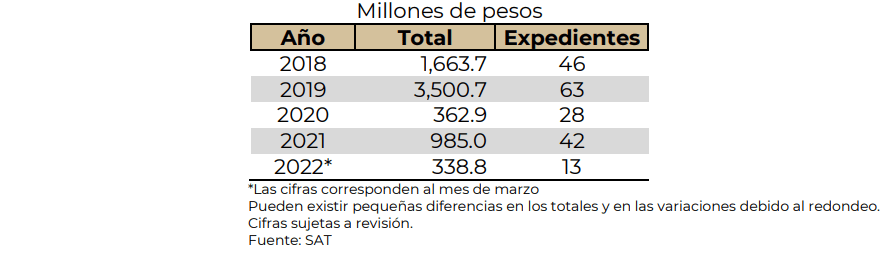

Monto en perjuicio al fisco Histórico anual

On the other hand, as of the first quarter of 2022, the SHCP reported that 30 suspensions of the importers’ registry have been requested, as a result of the systematization of the suspension process as of 2018, reaching a total of 733 requests in 2021.

SAT and the Address Verification Program

From December 2015 to March 31, 2022, 4,339 domicile verifications have been requested, of these approximately 25% were due to the non-location of the taxpayer at the tax domicile and/or registered and unregistered establishments before the SAT; resulting in the suspension in the importers’ registry.

At the same time, in the first quarter of 2022, 13 administrative files were integrated, whose amount of damage to the Treasury amounted to 338.8 million pesos, representing 34.4% of the total observed at the end of 2021 (985 million pesos).

The SHCP indicated that 9 administrative files were submitted to the General Legal Administration (5 for smuggling, 3 for presumption of smuggling, and 1 for vacating or disappearance of the tax domicile) for analysis and, if applicable, processing as a criminal matter, whose amount of damage to the Treasury amounted to 272.2 million pesos.

Likewise, 4 files were filed before the Federal Tax Attorney’s Office for the equivalent of tax fraud for an amount of 66.5 million pesos in damages to the tax authorities.

The SAT carries out control processes that seek to reduce illicit trade and position the country on a par with international best practices.

In this sense, SAT maintains an exchange of information with other tax and customs administrations to jointly combat commercial fraud and inhibit smuggling, money laundering and fraud.

In addition, the following measures were taken:

- Complemento Carta Porte in invoicing: digitalization of all cargo manifests regulated since 2004 in the Code of Commerce, and which have existed on paper since the 19th century at the international level. This strengthens the control mechanisms of the goods that are moved nationally, their origin and legal stay.

- Creation of the National Customs Agency of Mexico to strengthen security in customs clearance, points of illegal internment of merchandise, such as fuels through ships, pipes and tank cars.

![]()