The shortage of semiconductors could affect the growth of Mexico’s GDP in 2021 by approximately 1.3 percentage points, highlighted a member of the Governing Board of the Bank of Mexico (Banxico).

On the supply side, the majority of the members of the Governing Board highlighted the weakness of industrial production.

He pointed out that construction exhibits a poor performance and that manufacturing continues to show weakness.

One of them pointed out that they have relied mainly on the automotive industry and that modest progress is expected in solving the shortage problems in this sector during 2022.

In this regard and as an example, the Stellantis company experienced a loss of approximately 20% of its global planned production for 2021 as a result of unfilled semiconductor orders.

Stellantis also experienced a significant increase in the cost of raw materials that was partially mitigated by merger synergies and shortages of certain key components in 2021, but did not experience any material production losses as a result of material or parts shortages.

Stellantis generally obtains some of its systems, components, parts, equipment and tools from a single supplier or from a limited number of suppliers.

As with unfilled semiconductor orders in 2021, Stellantis risks production delays and lost production if any supplier fails to deliver goods and services on time.

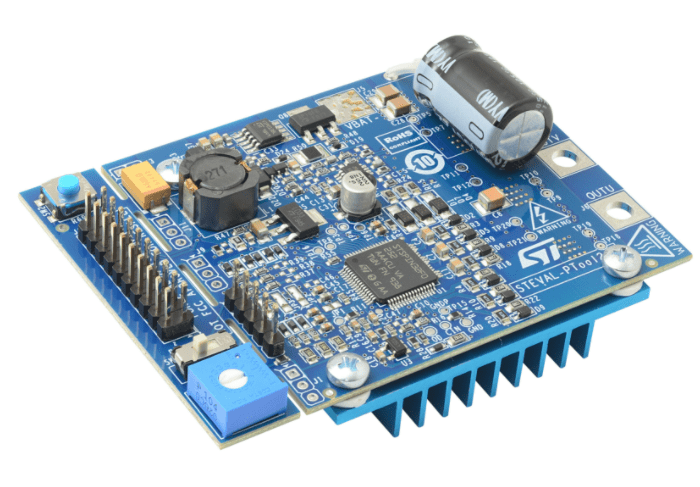

Semiconductor

In addition, while the company recently entered into several significant agreements with battery and raw material suppliers, as we implement its vehicle electrification strategy, it will also increase its reliance on a significant supply of battery components and related raw materials.

US industrial production contracted 0.1% monthly in December, after expanding 0.7% in November.

This moderation reflected a 1.5% contraction in gas and electricity generation and a 0.3% contraction in manufacturing activity, which is largely explained by the decline in automotive production, which continued to suffer from the effects of bottlenecks. and the shortage of semiconductors.

This was offset by a 2% expansion in mining, which mainly reflected gains in the oil and gas sector.

The Manufacturing Purchasing Managers’ Index suggests that this sector will maintain its recovery, although it is expected to continue to be constrained by persistent bottlenecks, high input costs and labor shortages.

![]()