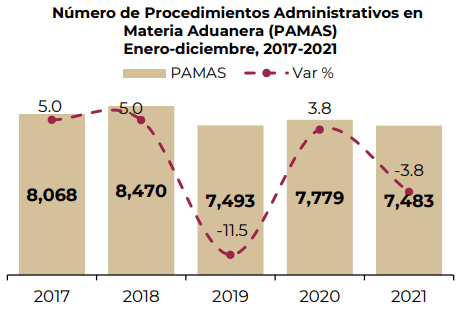

Mexico’s Ministry of Economy carried out 393 Administrative Procedures in Customs Matters (PAMAS) on imports in 2022, down from 7,483 in 2021, according to data from the Ministry of Finance and Public Credit (SHCP).

The 393 revisions totaled an approximate value of 1,565.3 million pesos.

The PAMAS executed were derived from in-depth and quick home visits (Art. 42, Sections III and V of the Federal Tax Code), verifications of foreign merchandise in transport and verifications of foreign vehicles in transit for not proving the legal importation, stay or possession of the merchandise in national territory, as actions to inhibit informal commerce.

A PAMA is the set of actions foreseen in the Customs Law, linked in a successive manner, with the purpose of determining the taxes omitted and, if applicable, imposing the corresponding penalties in foreign trade matters, respecting the right of the individual to a hearing when considering the evidence and arguments intended to justify the legality of his actions.

PAMAS

The objective? To establish the procedures and legal guidelines that customs must observe to initiate, substantiate and resolve administrative procedures in customs matters, derived from irregularities detected during the customs examination, second examination, from the exercise of verification powers or from the result of the report issued by the Central Administration of Customs Operation.

In other words, PAMA is the set of acts provided for in the Law, linked in a successive manner and whose purpose is to issue a condemnatory or acquittal resolution, derived from the incidences detected by the customs authority in the exercise of its powers of verification in foreign trade operations, respecting the guarantee of hearing of the individual when evaluating the evidence and analyzing the arguments that intend to prove the legal introduction, possession, possession or stay of foreign merchandise in national territory or the exit of national merchandise from national territory.

The PAMA will be initiated when on the occasion of the customs examination, second examination, verification of merchandise in transport and of vehicles of foreign origin in transit, domiciliary visits or any other act of verification, irregularities are detected that lead to the seizure of merchandise of foreign or national origin.

![]()