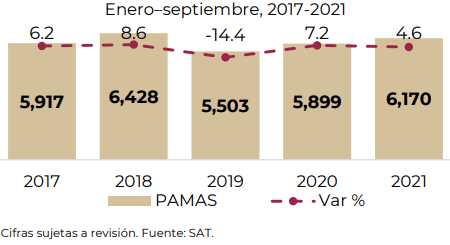

The Ministry of Finance and Public Credit (SHCP) registered a year-on-year increase of 4.6% in the number of PAMAS in Mexican customs from January to September 2021.

With this increase, as of the third quarter of 2021, 6,170 PAMAS were started.

The SAT carries out control processes that seek to reduce illicit trade and position the country on a par with the best international practices.

For this, the SAT maintains an exchange of information with other tax and customs administrations in order to jointly combat commercial fraud and inhibit smuggling, money laundering and fraud.

Number of Administrative Procedures in Customs Matters (PAMAS)

In Mexico, those who introduce or extract merchandise from the national territory, allocating them to a customs regime, are obliged to transmit to the customs authorities, through the customs electronic system, in an electronic document, a petition with information regarding the aforementioned merchandise.

In addition, these procedures must be carried out under the terms and conditions established by the Tax Administration Service (SAT), through rules, using the advanced electronic signature, the digital seal or another technological means of identification.

PAMAS

The customs authorities will draw up the act of initiation of the administrative procedure in customs matters, when, on the occasion of the customs recognition, the verification of goods in transport or by the exercise of the powers of verification, they pre-emptively seize goods in the terms provided by this Law.

This record must state:

- Identification of the authority that performs the diligence.

- Facts and circumstances that motivate the beginning of the procedure.

- Description, nature and other characteristics of the goods.

- Taking samples of the merchandise, if applicable, and other evidential elements necessary to issue the corresponding resolution.

The interested party must also be required to designate two witnesses and indicate an address to hear and receive notifications within the territorial district of the competent authority to process and resolve the corresponding procedure, except in the case of passengers, in which case, they may indicate an address outside said constituency.

![]()