With the entry into force of the Simplified Trust Regime in January 2022, by the first quarter of 2023 there will be a taxpayer registry of 3 million taxpayers.

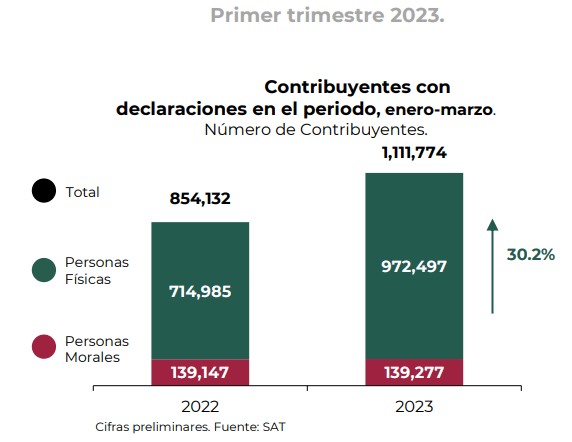

Since its creation, due to the administrative simplification offered by this regime so that tax payments can be made in a simple, fast and efficient manner, the filing of tax returns has increased by 30.2% compared to the same period of 2022.

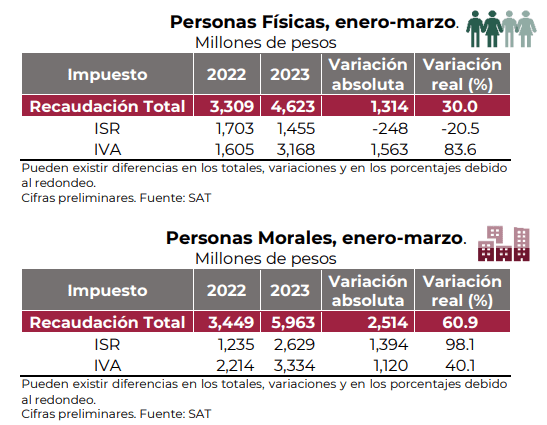

From January to March 2023, the total collection was 10,586 million pesos, which represents an increase of 45.8% in real terms, compared to the same period of 2022.

Simplified Trust Regime

The Resico is an administrative simplification so that the payment of income tax (ISR) is carried out in a simple, fast and efficient manner.

The objective of this new scheme is to reduce the rates of this tax so that people with lower incomes pay less.

This proposal of the Tax Administration Service (SAT) is based on international best practices.

The proposal is aimed at individual taxpayers who receive annual income of less than 3.5 million pesos invoiced in accordance with their economic activity, belonging to one of the four tax regimes that make up the Simplified Trust Regime:

- Business and professional activities.

- Tax Incorporation Regime

- Use or enjoyment of real estate (leasing)

- Agricultural, Livestock, Fishing or Forestry Activities.

This regime benefits 82% of individual taxpayers.

It is important to note that salaried workers will not participate in this regime but will remain under the Wages and Salaries Regime.

As of 2022, individuals under this new scheme will be required to pay between 1 and 2.5% of their income.

ISR

Due to these small ISR payment rates, taxpayers will not be able to deduct any type of expense.

This is due to the fact that, even with the deduction possibilities, the effective ISR rate for individuals was 25.4% during 2020, which represents 10 times more than the maximum rate of the Simplified Trust Regime.

The Simplified Trust Regime will include legal entities constituted only by individuals who are not associated with other legal entities, whose total income for the year does not exceed 35 million pesos, among other requirements.

According to economic censuses and information from SAT’s registers, there are more than 2 million legal entities that are constituted as micro, small and medium-sized companies that promote economic activation and boost competitiveness.