At the end of the first quarter of 2023, Tax incentives destined to different regions of Mexico amounted to 28.326 billion pesos, informed the Ministry of Finance and Public Credit (SHCP).

This amount is 7.809 billion pesos more, which is equivalent to an increase in real terms of 19.8% compared to the same period of 2021.

It is also higher by 4,092 million pesos or, in real terms, 8.8% compared to the same period in 2022.

Padrón de beneficiarios de los estímulos fiscales. Cierre a marzo 2023.

Derived from the entry into force of the tax incentive decrees for the northern border in 2019 and for the southern border in 2021, the following incentives were established: a tax credit equivalent to one third of the ISR caused in the fiscal year or in the provisional payments, and a tax credit equal to 50% of the VAT rate of 16% that is applied directly.

In addition, the Chetumal Free Zone Decree grants as a tax incentive the General Import Tax and the Customs Processing Fee.

Tax incentives

Companies located in the town of Chetumal, located in the municipality of Othón P. Blanco of the State of Quintana Roo will be able to enjoy the following benefits:

- Tariff relief of 100% of the general import tax on different goods in definitive import operations to the region or in the re-shipment of these to the rest of the national territory.

- Obtaining a credit equivalent to 100% of the Customs Processing Duty (DTA), which is usually .008 of the customs value of the import products. This also applies to definitive imports to the region or re-shipment of these to the rest of the national territory in accordance with article 49 of the Federal Law of Duties.

These tax incentives may be used by companies in the region that have made the corresponding request to the Ministry of Economy and have complied with the requirements satisfactorily.

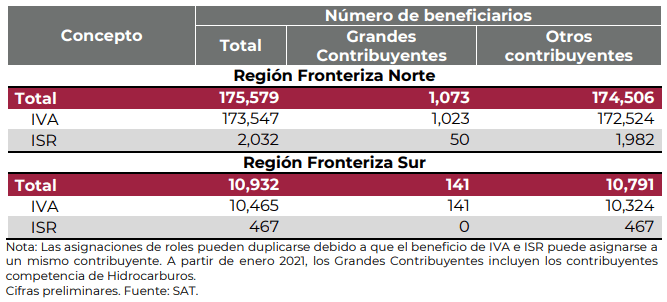

At the end of March of this year, 175,579 taxpayers received the benefits in the northern border, while in the southern border there were 10,932 beneficiaries.

SAT permanently implemented the programs «Verification of compliance with the requirements to apply the VAT tax incentive in the northern or southern border region» and «Verification in real time for the northern or southern border region», to verify that taxpayers comply with the necessary requirements to avoid abuses in the application of these incentives.