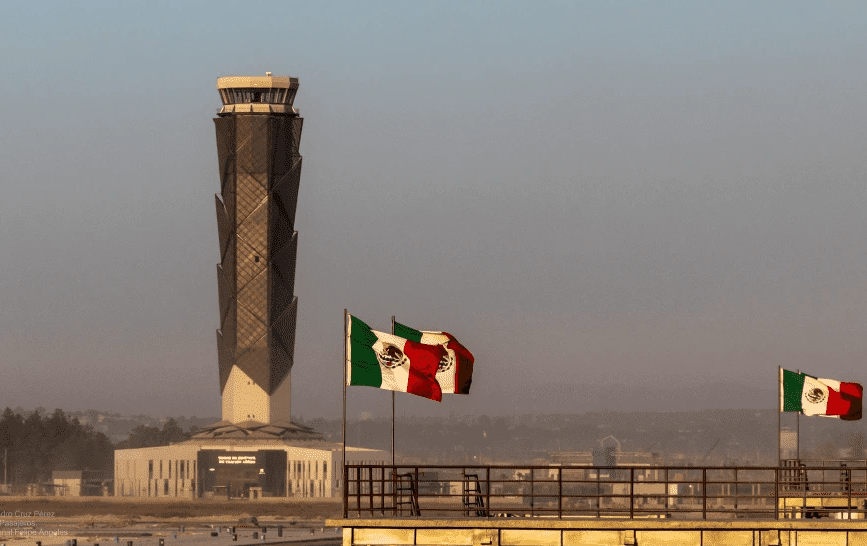

Mexico‘s Felipe Angeles International Airport (AIFA) has seven Bonded Warehouses and one Strategic Bonded Warehouse, according to information from the federal government.

So far, the Bonded Warehouses that already have their Registration Code are: AAACESA, INTERPUERTO, JC & JF (DHL), TALMA, ATMERCE, TERMINAL LOGISTICS and AZALE DEL MAR.

In addition, the Strategic Bonded Warehouse 3 PL GROUP 4 operates there.

Mexico has six types of customs regimes: definitive import, temporary import, bonded warehouse, internal or international transit of goods, processing, transformation or repair in bonded warehouses, and Strategic Bonded Warehouse.

The applicable legal framework for the regulation of the manufacturing, transformation or repair regimes in bonded warehouse and in strategic bonded warehouse is found in the Customs Law and in the General Foreign Trade Rules in force.

For the manufacturing, transformation or repair regime in bonded warehouse, the regulations are found in article 135 of the Customs Law and rules 4.7.1. and 4.7.2. of the General Foreign Trade Rules, as well as in Annex 29 thereof. With respect to the strategic bonded warehouse regime, the regulations are found in articles 135-A to 135-D of the Customs Law, as well as in Chapter 4.8 of the General Foreign Trade Rules, and in Annex 29 thereof.

Bonded Warehouses

In accordance with the regulations, the payment of the General Import Tax (IGI) is not made under the Strategic Bonded Warehouse (Recinto Fiscalizado Estratégico) regime, only its determination is made. When the merchandise is removed from the premises for its definitive importation is when the corresponding payment of the IGI is made. It is worth mentioning that the merchandise may remain in the Strategic Bonded Warehouse for up to 5 years.

Through the VAT and IEPS certification, taxpayers that introduce goods under the temporary import regime are granted a tax credit of 100% of the VAT and IEPS generated by the temporary imports they make.

As of December 31, 2020, a total of 3,467 companies had VAT and IEPS certification. Most of them imported goods to operate under the IMMEX Program (3,425), or under import regimes such as: tax warehouse (21), strategic bonded warehouse (20); and manufacturing, transformation or repair in bonded warehouse (1).

The sectors that have benefited from certification include mainly: auto parts, electronics, metal-mechanics, plastics and rubber, textile and clothing, and the electrical sector.

![]()