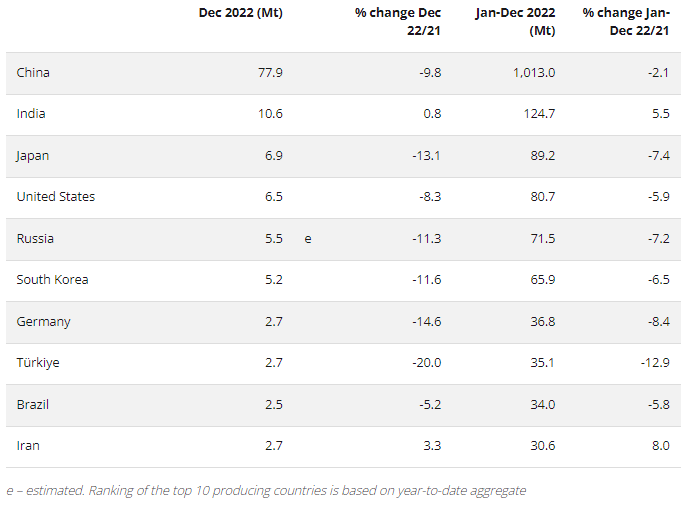

The world’s steel producers in 2022 include China (1,013 million tons), India (124.7 million) and Japan (89.2 million), according to the World Steel Association (Worldsteel).

Other major producers that year were the United States, Russia, South Korea, Germany, Turkey, Brazil and Iran.

US Steel said it faces competition from imports, much of it unfair and fueled by a huge global steel overcapacity, currently estimated at more than 500 million metric tons per year.

That amount of excess is more than five times the entire U.S. steel market and more than 17 times total U.S. steel imports.

Top 10 steel-producing countries

In particular, U.S. imports of certain steel products are subject to restrictions.

In particular, U.S. imports of certain steel products are subject to 25%, except for imports from Argentina, Brazil and South Korea: Argentina, Brazil and South Korea, which are subject to restrictive quotas; the European Union (EU), Japan and the United Kingdom (UK) which are founded and dumped in the EU/Japan/UK, within quarterly tariff rate quota (TRQ) limits; Canada and Mexico, which are not subject to tariffs or quotas, but could re-impose tariffs on overburdened product groups following consultations; Ukraine, which is exempt from tariffs until June 1, 2023; and Australia, which is not subject to tariffs, quotas, or an anti-surcharge mechanism.

Steel Producers

The U.S. Department of Commerce (DOC) is managing a process in which U.S. companies can request or oppose temporary product exclusions from Section 232 tariffs and quotas.

Multiple legal challenges to Section 232 action continue before the U.S. Court of International Trade (CIT) and the U.S. Court of Appeals for the Federal Circuit (CAFC), the latter of which has consistently rejected constitutional and statutory challenges to Section 232 action.

Since its implementation in March 2018, Section 232 action has supported U.S. steel industry investments in advanced steel production capabilities, technology and skills, strengthening U.S. national and economic security.

Separately, in February 2019, the European Commission (EC) implemented a definitive safeguard on global steel imports in the form of tariff rate quotas imposing 25% tariffs on steel imports in excess of the tariff rate quota limit, effective through June 2024.

Then, in December 2022, the EC initiated a fourth safeguard review.