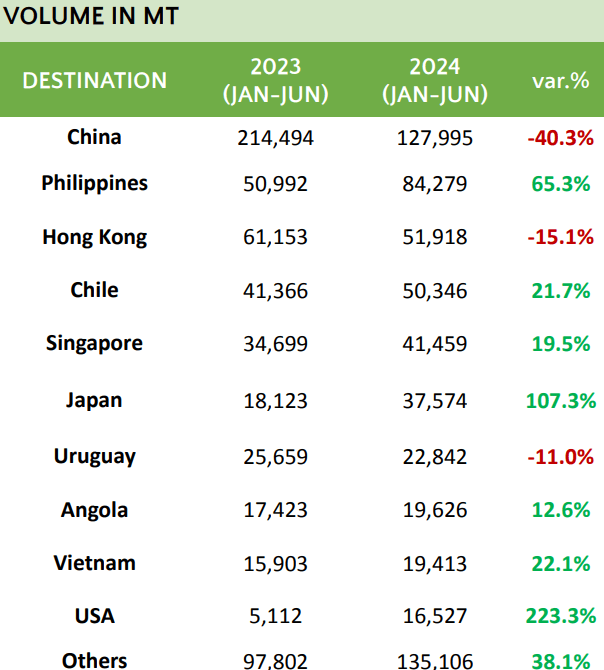

China and the Philippines were the main destinations for Brazilian pork meat exports in the first half of 2024.

As for the total volume of external sales of this meat from Brazil in the first half of the current year, this totaled 613,790 tons, reflecting a 4.1% year-on-year increase.

On the other hand, there was an 8% drop in this same indicator if measured in value, totaling 1.3 billion dollars.

Brazilian pork meat exports

According to the Brazilian Ministry of Industry, Foreign Trade and Services, the following were the main destinations of these exports:

- China: 127,995.

- Philippines: 84,279.

- Hong Kong: 51,918.

- Chile: 50,346.

- Singapore: 41,459.

History

Martin Afonso de Souza introduced pork to Brazil in 1532, bringing breeds from Portugal such as Alentejana, Transtagana, Galega, Bizarra, Beiroa and Macao.

During the Colonial Period, pork became a key ingredient in feijoada, a traditional Brazilian dish created by slaves.

They used less desirable parts of the pig, such as feet, tongues and entrails, mixed with bean broth to prepare this well-known stew.

International trade

Globally, pork exports from all countries increased 6.6% year-on-year to US$36 billion.

Here are the top six places, in millions of dollars:

- Spain: 6.76 billion.

- United States: 6.05 billion.

- Germany: 4.12 billion.

- Netherlands: 3.06 billion.

- Canada: 2.67 billion.

- Brazil: 2.63 billion.

According to FAO, economic growth in the main meat markets continues to be relatively slow.

Although China will continue to be the largest single market for meat, its economic recovery is uncertain.

China’s role in the global meat market remains vital, and although its share of world trade has declined from its peak, FAO expects it to account for 16% of the market by 2033.

There are signs that China could become less and less dependent on non-ruminant meat imports.

Since 2020, reduced pork imports have affected production in three of the top four exporters (the United States, the European Union, and Canada).

In contrast, Brazil has seen an increase in production, largely thanks to the depreciation of its currency, which has made its sector more competitive in the last decade.