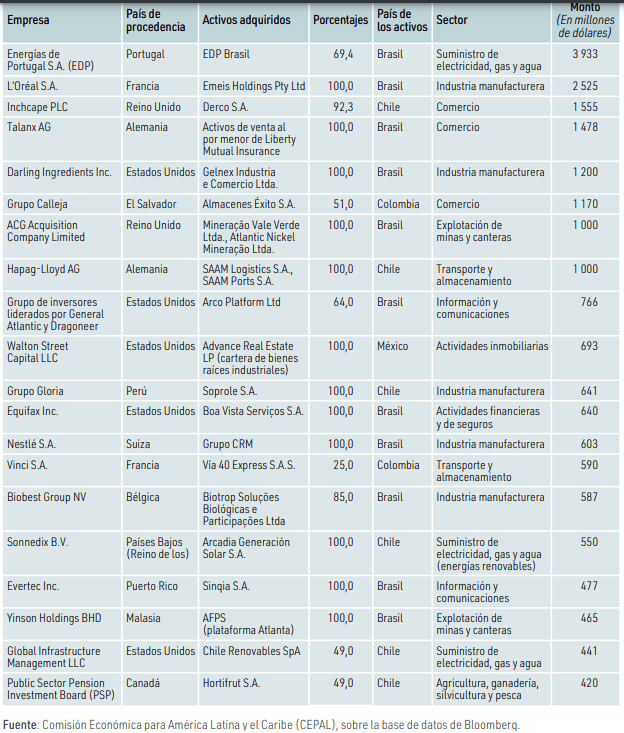

ECLAC ranked the top functions and acquisitions in Latin America and the Caribbean in 2023.

Among the largest acquiring companies are:

- Energias de Portugal S.A. (EDP).

- L’Oréal S.A.

- Inchcape PLC.

- Talanx AG.

- Darling Ingredients Inc.

- Calleja Group.

- ACG Acquisition Company Limited.

Functions and acquisitions in Latin America

In 2023, 370 M&A transactions were concluded in Latin America and the Caribbean, with a total amount of US$25,959 million.

Mergers and acquisitions are tools that companies use to grow, diversify or improve their market position.

By combining or acquiring other companies, they seek to strengthen their presence and take advantage of new opportunities.

While mergers occur when two or more companies combine to form a new entity, acquisitions occur when one company buys another company.

Although the number of deals in the region has returned to pre-Covid-19 pandemic levels and is on an upward trend, the total amount has not yet reached those previous levels.

Compared to 2022, the number of deals increased 15.3 percent in 2023, but the total amount decreased by 13.2 percent.

Leadership

Brazil was the leading destination for these transactions. In 2023, Brazil attracted 63 percent of the total amount and 44 percent of the number of deals in the region.

There were significant increases in both aspects: the total amount grew 73 percent and the number of operations increased by 26 percent.

In addition, Brazil was the site of six of the 10 largest deals of the year, standing out as a key market for transnationals in the region.

Investments

Chile ranked second in terms of amount, with 18 percent of the total, followed by Colombia with 9 percent.

Mexico, which was one of the main destinations in 2022, has been surpassed by Chile and Colombia, now representing 8% of the total.

This variation is due to the fact that the value of operations in Chile remained almost stable (with a growth of 1%) and in Colombia grew 38 percent.

In contrast, the value in Mexico declined 75 percent due to large operations in 2022, such as the merger of Televisa and Univision and the restructuring of Aeromexico.

In terms of number of deals, Mexico remains the second largest recipient, with 15 percent of the total.

Chile ranks third with 10%, while Colombia and Argentina are tied for fourth place, with 8% each.