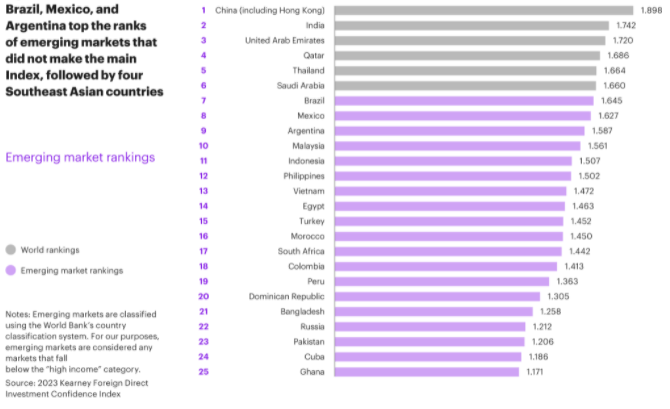

Hong Kong, United Arab Emirates, Qatar, Thailand, Saudi Arabia, Brazil, Mexico, Argentina and Malaysia are the emerging markets attracting FDI in the next three years, according to Kearney.

Bangladesh, Russia, Pakistan, Pakistan, Cuba and Ghana occupy the bottom five positions in the emerging markets ranking.

Russia is a notable case study, as its overall score fell from 1,622 in 2022 (immediately before the start of the Russia-Ukraine conflict) to just 1,212 this year.

This decline suggests that investors are predictably spooked by geopolitical crises, a conclusion borne out by the country’s net optimism score of -13.

Although net optimism levels for emerging markets are lower than their developed counterparts, investors are more optimistic than pessimistic about most of the emerging markets on the list, with Southeast Asia showing particular promise.

Emerging markets attracting FDI

The 2023 survey was conducted in January, when the economic outlook for the year was far from optimistic.

However, after months of economic projections that suggested a (potentially major) recession was looming, the outlook showed signs of improvement in the new year.

Inflation was falling, labor markets in major markets appeared to be rebalancing, and the International Monetary Fund released the January update of its World Economic Outlook, suggesting that it no longer expected a global recession next year.

Coupled with estimates from Oxford Economics that global FDI inflows increased slightly from $2.07 trillion in 2021 to $2.13 trillion in 2022, global investors are likely to feel somewhat more positive about the economic outlook than in previous months.

The survey results reflect continued optimism among investors. More than three-quarters (82%) said they planned to increase their FDI over the next three years, up slightly from 76% last year.

In addition, 87% cited FDI as most important to their companies’ profitability and competitiveness in the next three years, up slightly from 83% in 2022.

And investors’ outlook on the prospects for the global economy was broadly in line with last year’s results.

Although pessimism levels increased slightly from 32% to 35%, nearly two-thirds of investors (63%) were more optimistic than pessimistic about the global economy, exactly the same level as last year.