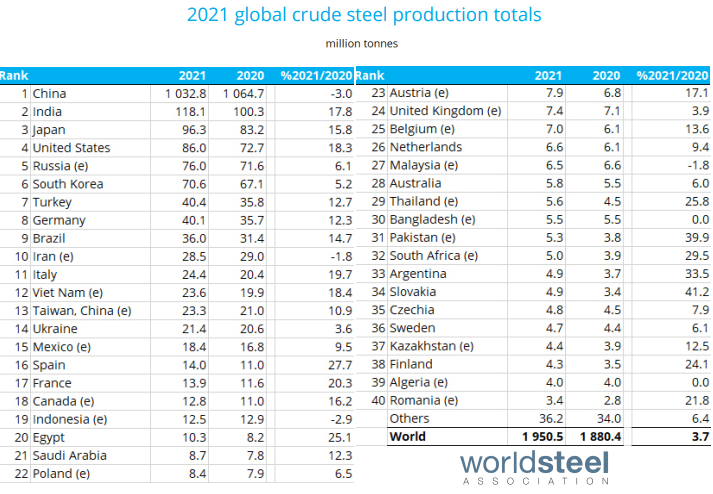

China, India, Japan, the United States and Russia make up the leading five countries among the world’s largest steel producers, according to the World Steel Association (worldsteel).

Worldsteel, headquartered in Brussels, Belgium, is a non-profit organization. Each year, it publishes a list of the largest steel-producing companies globally.

In 2021, China led production with 1,032.8 million tons, although this marked a 3% decline compared to the previous year.

The next three countries in the ranking saw significant growth. India increased production by 17.8%, reaching 118.1 million tons. Japan grew by 15.8%, producing 96.3 million tons, while the United States saw an 18.3% rise, totaling 86 million tons.

World production of crude steel for the 64 countries that report to worldsteel was 1,911.9 million tons in 2021, an advance of 3.6%, at an annual rate.

Steel producers

Historically, according to the Gerdau company, the steel industry has suffered from excess production capacity, which in recent years has worsened due to a substantial increase in production capacity in emerging countries, particularly China and India and other emerging markets.

China and certain steel-exporting countries have favorable conditions that influence steel prices. These include excess steel capacity, devalued currencies, and high market prices for steel products in other regions. These factors can significantly impact steel prices in global markets.

The largest steel producers, in descending order, include South Korea, Turkey, Germany, Brazil, and Iran.

US Steel, on the other hand, believes its main competitors in North America and Europe face similar environmental regulations. Therefore, the company does not consider that its position relative to these competitors is materially affected by environmental laws and regulations.

However, if future regulations do not recognize the fact that the integrated steelmaking process involves a series of chemical reactions involving carbon that generate carbon dioxide (CO2) emissions without linking these emissions to scrap steel as well, its competitive position in relation to minimills will be negatively affected.

Meanwhile, the company’s competitive position will be challenged by producers in developing countries. These countries include China, Russia, Ukraine, Turkey, Brazil, and India. The company’s position may suffer unless these nations implement proportional reductions in CO2 emissions or establish border adjustment fees for CO2.