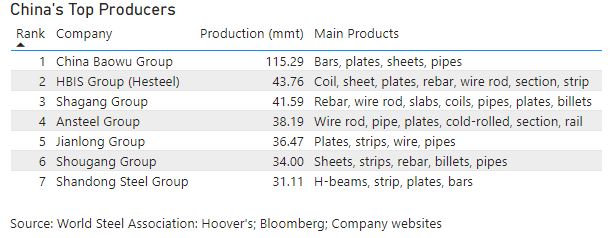

China Baowu Group is at the forefront of the largest steel producing companies in China during 2020, with a total of 115.29 million tons, according to data referred to by the United States Department of Commerce.

In China, production decreased 2.9%, from 1.1 billion metric tons in 2020 to 1 billion metric tons in 2021.

Since 2015, production has consistently outpaced apparent consumption (a measure of steel demand).

The gap between this measure of steel production and demand increased to 36.9 million tons in 2021, from 13.0 million tons in 2020.

Likewise, import penetration decreased from 3.7% in 2020 to 2.8% in 2021.

Producing companies

China ranked as the world’s largest steel importer in 2021, according to the World Steel Association.

In 2021, China imported 28.0 million metric tons of steel, a decrease of 27.4% from 38.6 million tons in 2020.

Following China Baowu Group, they followed in the ranking of the main Chinese producing companies: HBIS Group (Hesteel, 43.76 million tons), Shagang Group (41.59 million), Ansteel Group (38.19 million), Jianlong Group (36.47 million), Shougang Group (34.00 million) and Shandong Steel Group (31.11 million).

Despite this trend, the global steel market remains highly fragmented.

In 2020, the five largest steel producers, China Baowu Group, ArcelorMittal, HBIS Group, Shagang Group and NSC, accounted for 17% of total world steel production, compared to 15% for the five largest steel producers in 2000.

Prices

Ternium states that events that contribute to continuously volatile steel price cycles include spikes and troughs in commodity prices, new additions of steelmaking capacity (at a rate higher than the growth in steel demand ), downtime and restart of steelmaking capacity, and adverse economic conditions.

For example, in the United States, steel prices trended lower for most of 2018 and 2019, after peaking during the first half of 2018, as a result of lower steel consumption, higher production of steel and, in 2019, lower steel scrap costs.

Steel prices then declined further in 2020 during the early stages of the Covid-19 pandemic, reflecting a depression in steel consumption.

However, after an initial drop, steel prices rose steadily throughout the rest of 2020 and reached record levels in September 2021, as the speed of the recovery in steel production and raw material production steel companies did not meet the demand for steel.

Since then, steel prices declined rapidly in a scenario of normalization of the balance between supply and demand for steel until February 2022, when they increased significantly after the start of the armed conflict between Russia and Ukraine.