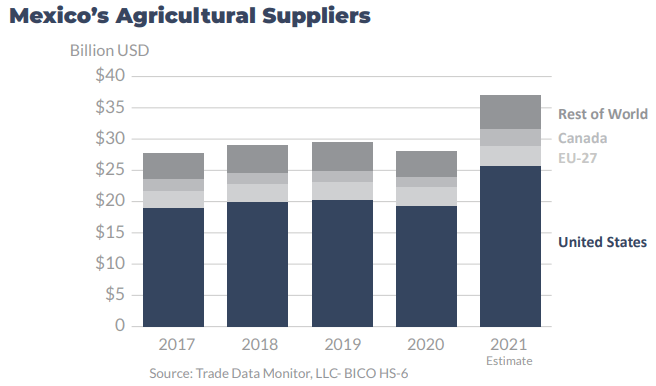

The United States maintained a dominance in agricultural imports to Mexico, indicated the Department of Agriculture (USDA).

In 2021, US agricultural exports to Mexico reached a record $25.5 billion, an increase of 39%, making Mexico the second largest export destination for US agricultural products.

The United States is the main supplier of agricultural products to Mexico with a market share of almost 70 percent.

While bulk commodity price increases are largely responsible for higher overall export values (eg soybeans), export volumes of other commodities also increased.

Mexican agricultural imports of US pork and pork products increased 29% in volume (up 51% in value), indicating stronger consumer demand.

Agricultural imports

Wheat is another commodity where export volume increased significantly, 34% to almost 4 million metric tons (advancing 68% in value).

Demand for imported dairy products from the United States also increased 17% in volume (28% increase in value) from 2020. Overall, US agricultural exports to Mexico increased in almost all commodities.

Among the main drivers were:

- Mexico’s economic growth has been slow in recent years, although it is recovering from the 2020 pandemic recession. Mexico’s GDP in 2021 was nearly $1.3 trillion, an increase of $200 billion from 2020.

- In general, US agricultural exports to Mexico are driven by a variety of products. In 2021, Mexico was the top export market for U.S. dairy products, wheat, poultry, soluble dry distillers grains (DDG), and rice.

- Mexico is also the second largest export market in the United States for many other important agricultural products, such as corn, soybeans, soybean meal, fresh fruits and vegetables.

- Geographic proximity and strong cultural ties make Mexico a key market for U.S. processed food exports. In fact, Mexico ranks as the second-largest importer of food preparations and baked goods from the United States.

- In 2021, Mexico’s recovery from the economic impacts of COVID-19 boosted agricultural and food exports from the U.S. This recovery followed the reopening of the hotel, restaurant, and institutional sectors, as well as the return of international travel.

- Mexico’s expanding livestock and poultry industries, combined with higher grain and soybean prices, also drove up the value of bulk commodities like corn and oilseeds.

- The United States remains Mexico’s top choice for food imports. This preference is due to its geographic proximity, high product quality, competitive pricing, and the closely integrated supply chains between both countries.

Hotels

Mexico showed signs of recovery in the hotel, restaurant and institutional sectors with the number of international visitors increasing to 19.4 million, and with an inflow of revenues of 9.3 billion dollars.

These figures elevated Mexico in the ranking as the third most visited country in the world, even after the closure of 13,000 restaurants in 2020.