Exports of products from the United States to Mexico registered an interannual fall of 8.2% in March, adding up to 20,048 million dollars.

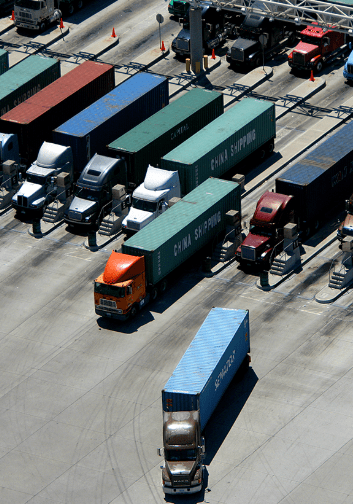

The United States exports products such as gasoline, cars, corn, auto parts, integrated circuits, computers, telephones, plastic items, and soybeans to the Mexican market.

Cumulatively, US exports to Mexico totaled $ 60,279 million, reflecting a 5.7% drop, at the annual rate.

In addition to final goods, companies send from the United States to Mexico a wide variety of inputs, parts and components that Mexican factories use both to re-export higher value-added goods or final goods to the United States, and to sell them to third countries.

In general, including Canada, the North American region is highly integrated in its value chains, especially in manufacturing, benefiting from the region’s complementarity in aspects such as natural resources, labor, and sources of capital. among others; the elimination of tariffs through the North American Free Trade Agreement (NAFTA), and shared production.

Exports and new rules

These regional trade flows are expected to increase as a consequence of higher regional content requirements, especially in the automotive industry, required by the Treaty between Mexico, the United States and Canada (T-MEC), which is scheduled to enter into force. next July 1, to replace NAFTA.

In the first quarter of 2020, US exports were affected by the global pandemic of COVID-19 and by a stagnation in the Mexican economy.

From around the world, imports from Mexico totaled $ 35,007 million in March, a 6.7% drop, at an annual rate, according to Inegi data.

This figure reflected variations of (-) 5.1% in non-oil purchases and (-) 20.6% in oil purchases.

When considering imports by type of good, annual decreases of 11.5% were observed in consumer goods, 4.6% in intermediate-use goods and 18.1% in capital goods.