The outlook for the wheat harvest for the 2021/22 fall/winter cycle is poor in Mexico, according to the National Wheat Flour Chamber (CANIMOLT).

Specifically, these prospects correspond to the harvest of the 2021/22 fall/winter cycle in Sonora, Sinaloa, Chihuahua and the Bajío region.

With this, the United States Department of Agriculture (USDA) refers that it demonstrates the continued trend of farmers switching from bread wheat to durum wheat or corn.

Planting for this cycle took place in October and November 2021, prior to Russia‘s invasion of Ukraine and the consequent increase in international wheat prices.

Earlier, globally in 2021, the beef segment experienced strong demand and ample supply of market-ready cattle, Cargill indicated.

While the pork segment experienced strong demand and lower supply of hogs, the chicken segment experienced strong demand relative to supply.

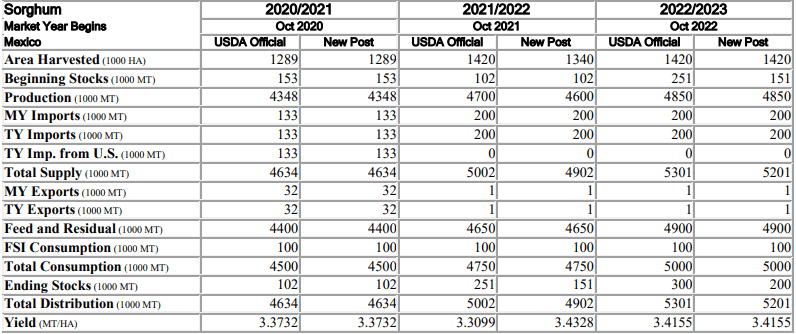

Mexico, Sorghum Production, Supply, and Distribution

On the other hand, the prepared foods segment experienced growth, but faced increased costs, partly due to the impact of an inflationary environment and challenging labor and supply conditions during fiscal 2021

Wheat harvest

USDA’s recent forecast for Mexico’s 2022/23 marketing year wheat production (July/June) was revised downward compared to USDA’s official forecast, based on updated information from industry and official Mexican government sources, reflecting projected unfavorable weather conditions and ongoing payment delays from the guaranteed price subsidy program, which are expected to limit producers’ available funds for planting.

CANIMOLT reported adverse weather conditions during the planting season, highlighting the lack of rainfall during planting and cultivation.

Low rainfall reportedly affected both bread wheat and durum wheat, despite the latter’s relative drought resistance.

USDA industry contacts and official sources project lower production in the 2022 spring/summer growing season compared to the 2021/22 fall/winter season, based on reported planting intentions.

The lack of drought- and frost-resistant varieties limits production in the spring/summer cycle, and a large portion of the spring/summer wheat crop is traditionally destined for forage.

Industry contacts estimate production for the 2022 spring/summer cycle at 120,000 MT, a reduction resulting from the elimination of the Term Contract government subsidy, which used to support production of 220,000 MT of wheat for the spring/summer cycle.

On the other hand, industry sources note that price is the determining factor for wheat producers, and industry sources suggest that there may still be time to increase plantings in response to higher international wheat prices.

![]()