Global containerized seaborne cargo volumes decreased 4.3% in 2022, and in the third quarter were below Q3 2019 levels, Maersk said.

Likewise, air cargo (CTK) volumes decreased 7.4% from January to November compared to 2021 and were also below levels seen during the same period in 2019.

According to Drewry, port traffic volumes declined 0.5% in 2022, weaker than the 7.1% in 2021.

In contrast, vacancy rates for industrial and logistics warehousing remained low by historical standards (3.3% in the U.S.).

Containerized seaborne

Maersk expounded that pressure on global supply chains eased during the year, resulting in improved reliability of ocean logistics.

The share of the global container fleet absorbed by delays fell from nearly 14% in January 2022 to 6.7% in October, according to Sea-Intelligence.

However, inland logistics continued to face difficulties in some regions and ports due to several factors: continued shortages of truck drivers and equipment, diversion of Russia-bound cargoes, low water levels in parts of Europe, high inventory levels clogging ports and warehouses, strikes, flooding in parts of Asia, and lockouts in China.

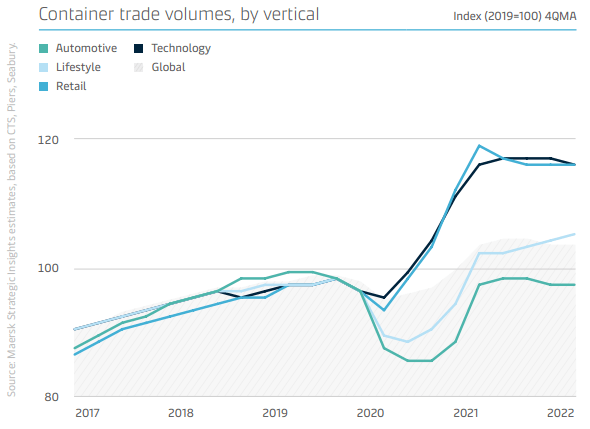

Demand developments were not uniform across all sectors. The main change was in retail and technology products, where demand was exceptionally strong during the pandemic, driving container volumes well above their pre-pandemic trend.

During 2022, consumers reduced their spending on these products and container volumes began to normalize.

In contrast, other verticals, such as lifestyle products, did not experience the same overconsumption and container volumes progressed in line with the pre-pandemic trend.

Logistics

The automotive sector continued to be impacted by supply chain issues and semiconductor shortages, as well as consumer hesitancy, resulting in container volumes well below trend.

From a sales channel perspective, e-commerce penetration also began to normalize during 2022, underscoring the need for agile omni-channel logistics solutions. Container volumes declined on most shipping lanes in 2022 compared to 2021.

Volumes into and out of Europe weakened due to the Russian invasion of Ukraine, leading to a direct loss of trade with Russia and a deteriorating European economic environment.

While volumes to Far East Asia deteriorated due to weak domestic demand and COVID-19 policy in China, import volumes from North America also declined on the back of the economic slowdown, changing consumer demand and inventory correction.

However, container volumes remained above 2019 levels in several regions, including Latin America, Oceania, Asia and the Americas.

![]()