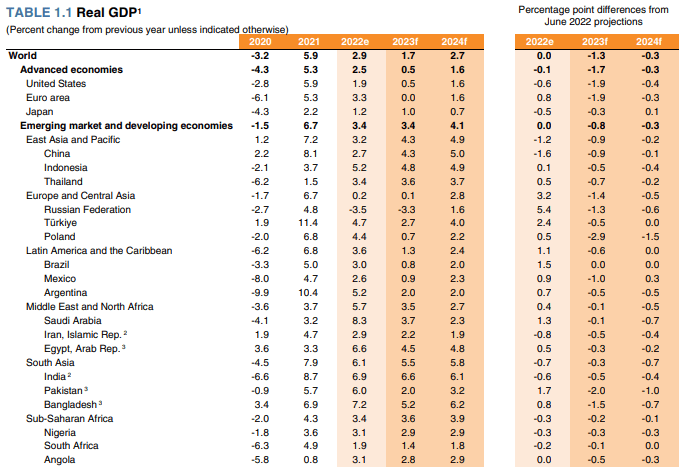

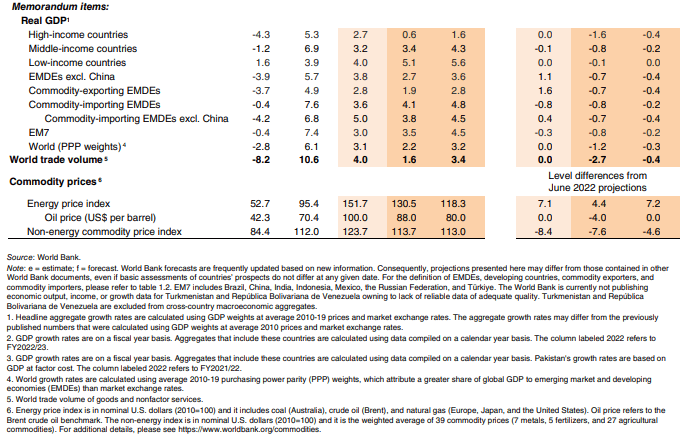

The World Bank projected that the world economy will slow sharply to 1.7% in 2023, the third weakest pace of growth in nearly three decades, eclipsed only by the global recessions caused by the pandemic and global financial crisis.

This figure is 1.3 percentage points below previous forecasts, reflecting the synchronized tightening of policies aimed at containing very high inflation, worsening financial conditions, and continued disruptions from the Russian invasion of Ukraine.

The United States, the euro area and China are experiencing a period of pronounced weakness, and the resulting contagion effects are exacerbating other headwinds facing emerging market and developing economies (EMDEs).

From the World Bank’s perspective, the combination of slow growth, tightening financial conditions and heavy indebtedness is likely to weaken investment and trigger corporate defaults.

Other negative shocks -such as rising inflation, further policy tightening, financial stress, further weakness in major economies or increased geopolitical tensions- could push the global economy into recession.

In the short term, urgent global efforts are needed to mitigate the risks of global recession and debt overhang in emerging and developing countries.

World economy

Given the limited room for policy maneuver, the World Bank felt it is critical that national policymakers ensure that any fiscal support is focused on vulnerable groups, that inflation expectations remain well anchored, and that financial systems remain resilient.

Policies are also needed to support a significant increase in investment in emerging and developing countries, which can help reverse the long-term growth slowdown exacerbated by the overlapping shocks of the pandemic, the invasion of Ukraine, and the rapid tightening of global monetary policy.

This will require new funding from the international community and the reallocation of existing spending, such as inefficient agricultural and fuel subsidies.

In addition, according to the World Bank, urgent global action is needed to mitigate the risks of global recession and debt overhang in emerging and developing countries.

Due to limited policy space, it is critical that national policymakers ensure that any fiscal support is focused on vulnerable groups, that inflation expectations remain well anchored, and that financial systems remain resilient.

Policies are also needed to support a significant increase in investment in emerging and developing countries, including new financing from the international community and from reallocating existing spending, such as ineffective agricultural and fuel subsidies.